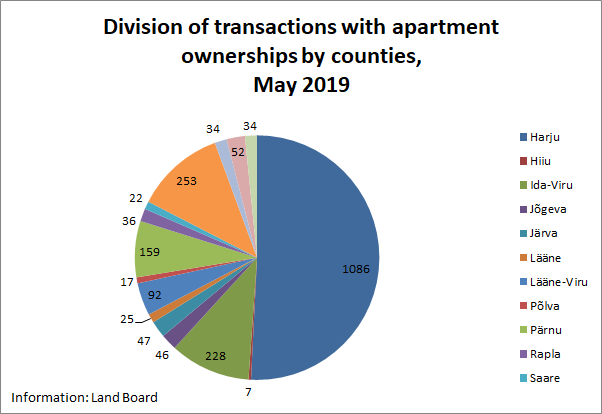

After the surge in March and April, the first hot days of May brought along a larger leap in the transaction activity. The larger numbers were not based only on the Harju County but the increase was rather broad.

2,138 sales-purchase transactions of apartment ownerships were concluded in May, which was more than during any one of the first four months of the year. Last month with over 2000 transactions was last October. The large number of transactions was based both on the active market of new developments and the active secondary market, as, for instance, in Harju County, fewer transactions were concluded than in March. Due to the slightly lower share of Harju County, considering the highest activity of the year, the median price of transactions was the lowest – 1,276 EUR/m2, which was the smallest figure since last September. On a broad scale, the market is showing clear signs of stabilisation – in the first five months of the year, 9,363 transactions have been concluded (+276 in comparison to the same period in 2018), the median price of the transactions was 1,353 EUR/m2 (+7 EUR/m2).

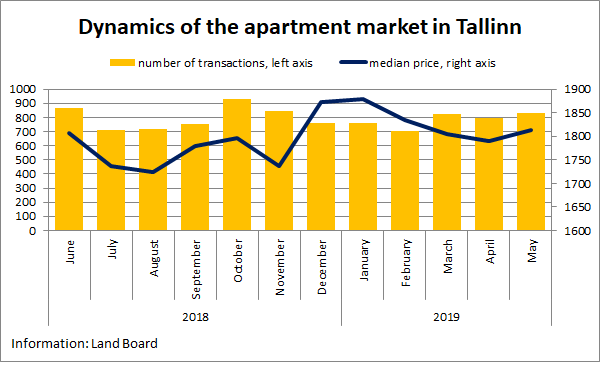

Apartment Market in Tallinn

The market of Tallinn contributed little to the growth in the number of transactions – 831 sales-purchase transactions were concluded in May, which was 8 transactions more than during the previous best month this year. In the past year, 9,496 transactions have been concluded in Tallinn, i.e. an average of 791 transactions per month. Over 150 transactions were concluded in three city districts – the Centre, Lasnamäe and Northern Tallinn, the largest growth in comparison to last month took place in the Centre where 140 transactions were concluded in April. The median price of transactions is still very high in Tallinn, and as has been already remarked, the figure is moving up also this year. In May, the median price of transactions was 1,813 EUR/m2 and during the past six months, the median price has remained under 1,800 EUR/m2 only in one month. The median price of the transactions in the past year was 1,798 EUR/m2 that of the past six months was 1,837 EUR/m2, which indicates a calm price increase.

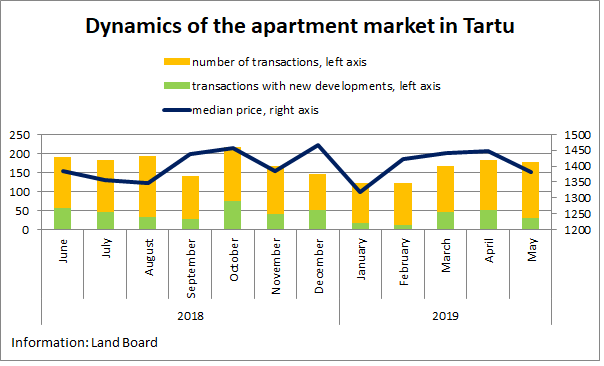

Apartment Market in Tartu

Similarly to Tallinn, the market was also stable in Tartu, mainly thanks to the active secondary market. In May, 177 transactions were concluded in Tartu, the median price of transactions was 1,380 EUR/m2. Due to the active secondary market, the median price of transactions fell below 1,400 EUR/m2 for the first time in three months. However, the market of Tartu has still considerably grown in the past 12 months – 2,010 transactions were concluded in the past 12 months, with a median price of 1,410 EUR/m2, whereas the respective figures in the previous 12-month period were 1,791 transactions and 1,325 EUR/m2.

The figures of Tartu rather accurately reflect the development of the market of new developments outside Tallinn where due to smaller volumes, the transactions are not distributed evenly over a year but boost the figures of certain months; therefore, the figures of standard deviation in smaller towns are relatively higher. As the correlation of the total transactions and the transactions with new developments is very high, it is no wonder that the number of transactions with new developments in the most active month of the past 12 months (i.e. October) was also the highest of the past 12 months.

The same tendency works also the other way round – during the least active months (i.e. in January and February) also the smallest number of transactions with new developments were concluded in comparison to other months. In smaller markets, e.g. Pärnu, the differences are even more prominent.

Apartment Market in Pärnu

Spring brought increased activity of transactions to Pärnu – as the number of transactions in the first three months remained between 56 and 64, thanks to 34 transactions with new developments (i.e. 18 more than in the first three months), already 101 transactions were concluded in April, and thanks to 33 transactions with new developments, 114 transactions were concluded in May. In the comparison of years, the growth this year is supported by the low baseline of last year – in the first five months of the year, 396 sales-purchase transactions have been concluded in Pärnu, which is 65 more than last year, the median price of the transactions was over 50 EUR/m2 higher (1,185→1,246 EUR/m2).

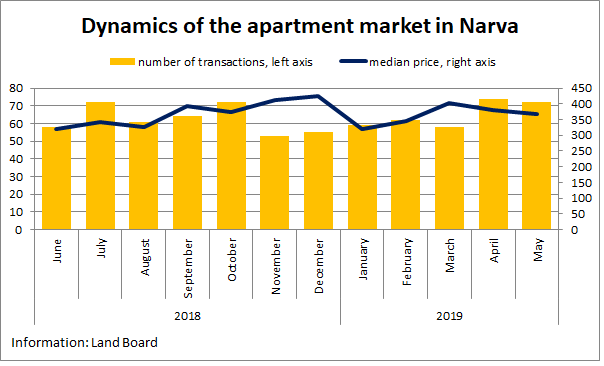

Apartment Market in Narva

For the market of Narva, it is appropriate to use a slightly modified saying “No changes in the eastern front”. 72 sales-purchase transactions were concluded in May, i.e. the market was slightly more active than during the past 12 months with 63 transactions per month. The median price of transactions in Narva was 368 EUR/m2, and in the first five months of the year, Narva has slightly recovered in comparison to last year – over 50 transactions more have been concluded (274→325); the median price of transactions is still very low in the third city of Estonia, this year the figure is 369 EUR/m2, last year it was 421 EUR/m2. The best times of both Pärnu and Narva in the context of the modern real estate market remained in the previous decade – then, Pärnu could boast of an even higher median price than in Tartu, but the median price of transactions in Narva in 2007 was 841 EUR/m2, which today seems to be a completely fictional figure.