April transactions strongly reflect the changes in the real estate market. The lower number of transactions is mostly based on lower offering – according to KV.EE, the offering of apartments has increased in comparison to the beginning of the year, but it is lower than last year by nearly one third. However, in Harju County and especially in Tallinn where real estate is the least affordable, the market is equally influenced by increased insecurity of consumers due to fast inflation and the war in Ukraine.

The upcoming increase in interest rates will have a negative effect on nearly twenty five percent of Estonian homeowners, as most housing loans have been taken at market prices, and the share of loan obligations from the income has increased. A drop in the number of transactions and increase in interest rates are the main indicators of a drop in real estate prices, whereas rapidly increased input prices and strong demand push the prices to the opposite direction. Therefore, we will soon see how the two market powers compete, and as a result will see a clearer picture regarding the change in real estate prices.

Estonia

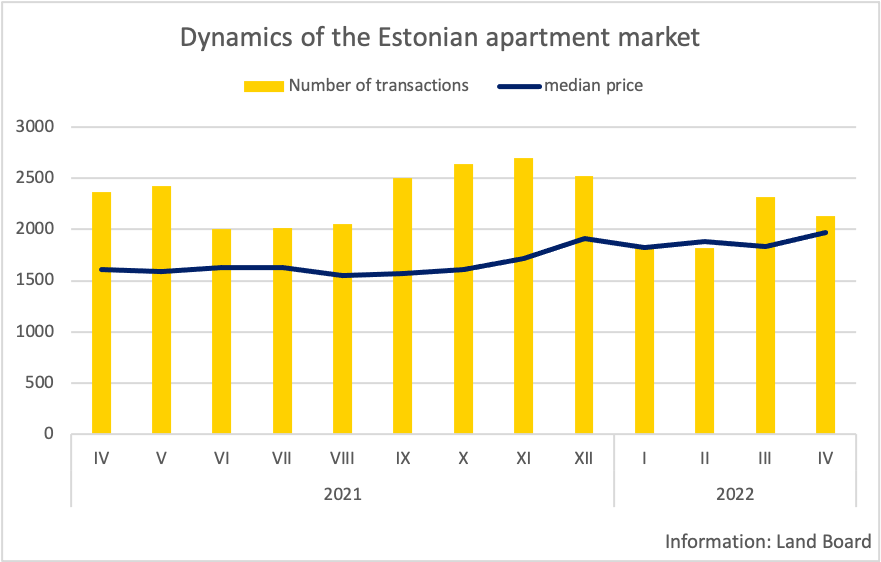

In comparison to March, the results in the apartment market were even lower in April. If 2,314 sales-purchase transactions of apartment ownerships were concluded in March, the number of transactions in April was 2,131, which was 10 percent less than during the same period last year. During the first four months of the year, the number of transactions has dropped by 4%. The median price of transactions in April was 1,966 €/m2, which was a record-breaking result and exceeded the result of last March by 22%. During the first four months of the year, the median price has increased by nearly 20%.

Based on the transactions of the first four months, the number of transactions dropped in seven counties in the comparison of years: 10% in Harju County, 2% in Tartu County and 1% in Pärnu County, whereas the number of transactions in Ida-Viru County increased by 13%. The median price only dropped in Järva County, but due to a larger number of transactions, the transaction turnover strongly increased both in Järva County and other counties in comparison to last year (3% in Harju County, 11% in Tartu County, 26% in Pärnu County, 28% in Ida-Viru County).

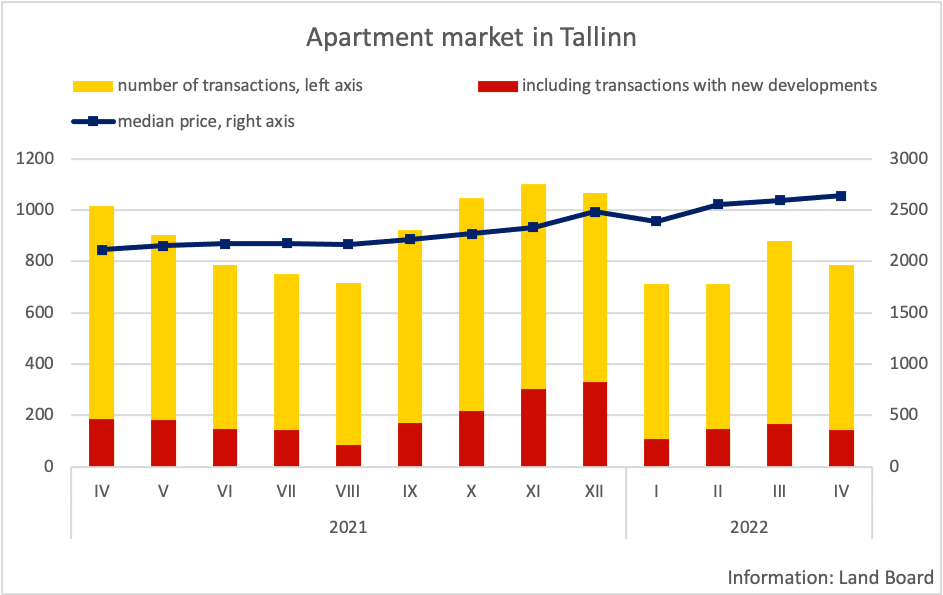

Apartment market in Tallinn

788 transactions were concluded in Tallinn in April, which was nearly 23% less than during the same period last year. In addition to lower offering (about 300 apartments less in the past year), the market is increasingly influenced by global factors such as fast inflation, lower purchase power, insecurity caused by the war in Ukraine, and the upcoming increase in interest rates. Lower middle class and poorer people have suffered most from the insecurity, and as data shows, there has been no price increase of the secondary market apartments at the so-called “hills” this year. Sales figures of new apartments are still good, so it makes sense to predict an increase in the gap between the prices of older and new apartments. 14% transactions less (-6% in the secondary market) have been concluded in the first four months of the year. The median price of transactions was record-breaking in April (2,643 €/m2), and records will be broken at least during the next 12 months, as new developments are included in the statistics with a delay, and their number will also increase. In comparison to the first four months of last year, the median price has increased by 20% (2,138→2,556 €/m2) this year.

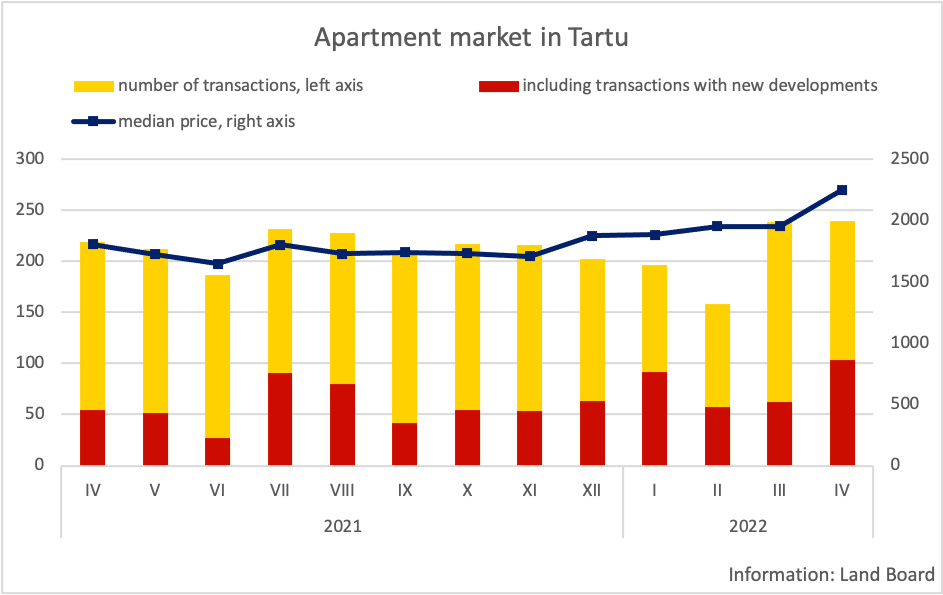

Apartment market in Tartu

In Tartu, almost the same number of transactions were concluded as last month. However, the biggest difference was that the share of first-hand sales was even 43% of the transactions. 136 transactions were concluded in the secondary market, which was 40 less than in March and 12 less than during the same period last year. Like in the market of Pärnu, low offering is still the main factor influencing the market; however, global trends should reach the market sooner or later. Low offering and large share of new developments naturally resulted in a new price record, the median price crossed the threshold of 2,000 €/m2 for the first time, reaching the level of 2,248 €/m2. In the first four months of the year, thanks to the increase in the number of transactions with new developments, the number of transactions has increased by 2% (820→835), even though the number of transactions in the secondary market has dropped by 7%. Based on the transactions of the first four months, the median price of transactions was 2,007 €/m2, and in comparison to the same period last year, the price level has increased by 12%.

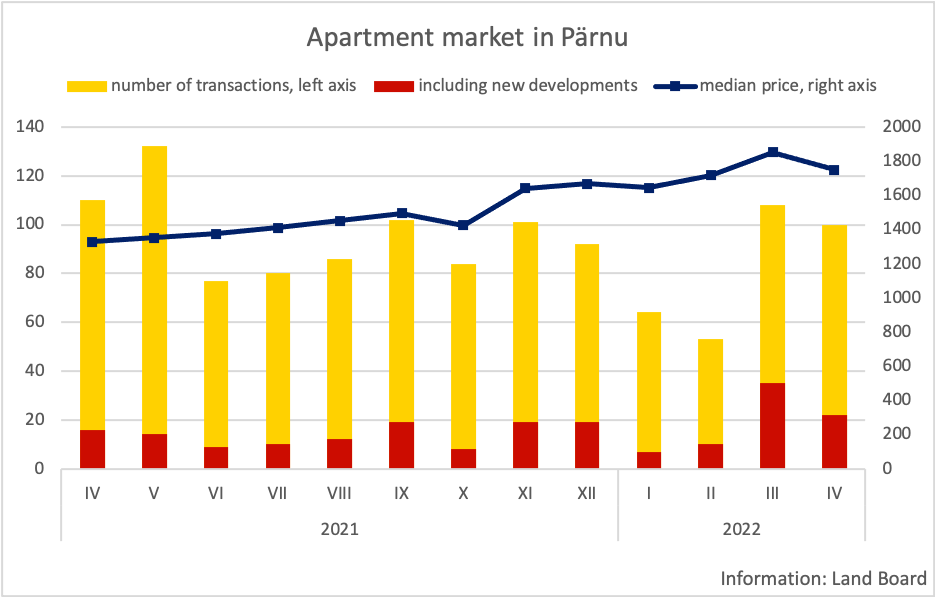

Apartment market in Pärnu

Active March in Pärnu was followed by active April. 100 transactions were concluded, 22 of which were for apartments in new developments. 78 transactions on the secondary market mean the best result of the current year, and the number of transactions was at least 100 for the second consecutive month. In comparison to last year, however, the decline in offering clearly prevents the number of transactions from increasing further. Even though the insecurity of consumers has not reached the market yet, the number of transactions concluded in the secondary market in the first four months of the year was 17% less, and only thanks to the larger share of new developments the decline in the number of transactions has remained below 10% (350→327). The median price of transactions in April was 1,750 €/m2. In the first four months of the year, the median price has increased by even 38% (1,268→1,750 €/m2) in comparison to last year.

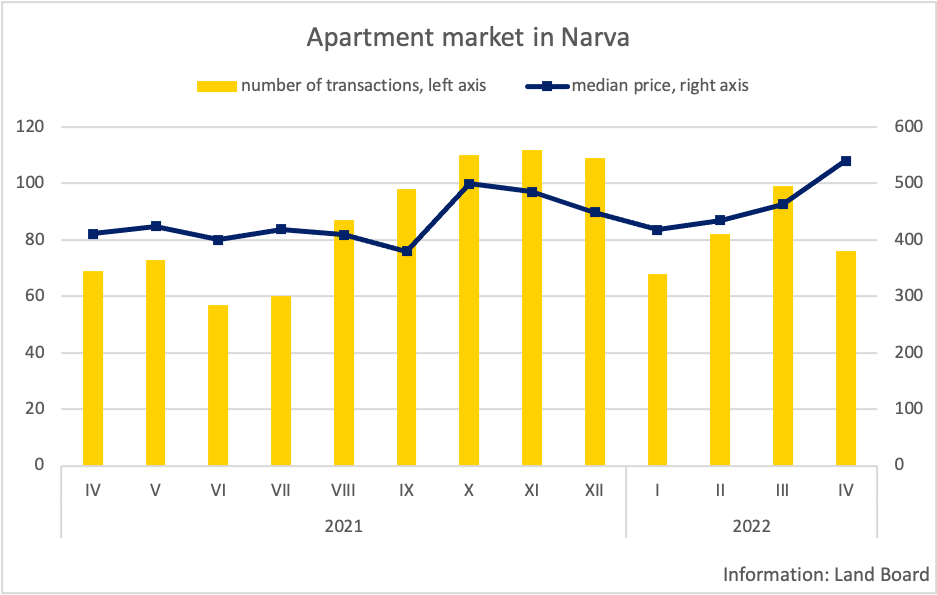

Apartment market in Narva

Despite the low offering, 76 transactions were concluded in Narva, which was less than in February or March, but 7 more than during the same period last year. Low offering and high activity have increased the asking prices, which in the past two months has also been reflected in the transaction price increase. The median price of transactions was 540 €/m2. The last time when the median price crossed the threshold of 500 €/m2 was in September 2014, but the average salary level was about 50% lower then. In the first four months of the year, the market of Narva has been very active: the number of transactions has increased by 14% (285→326), the median price by 8% (430→464 €/m2) and transaction turnover by 23%.

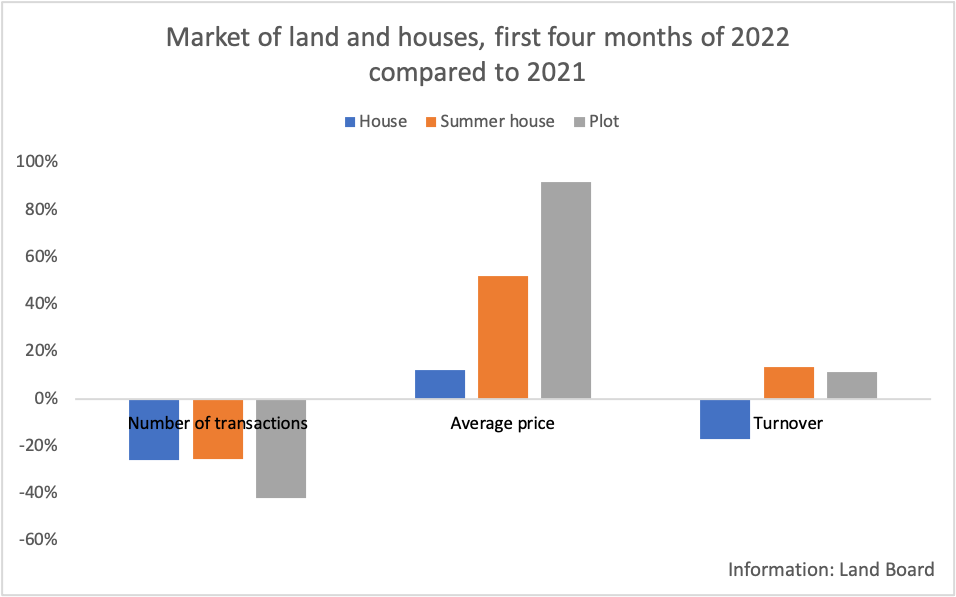

The market of houses and summer houses

The market of houses and summer houses is strongly influenced by the rapid increase in energy prices and construction prices. In April, 222 transactions were concluded for houses and 71 for summer houses, which was as much as in March, but about 40% less than last April when the market was very hot. When comparing the first four months of this year, the number of transactions for houses and summer houses was 26% lower than last year, and even though the average sales price of houses has increased by 12%, the turnover is even 17% lower due to a larger drop in the number of transactions. A similar trend can also be observed in the market of plots where the number of transactions is lower (-42%), but the price level has quickly increased (turnover +11%).