In the past months, the real estate market has acquired boom-like characteristics: low offering has not yet managed to keep pace with high demand, and thus we can see sales activity and price increase that we could hardly even dream about six months ago.

We will probably not see a drop in activity this year, as also the funds extracted from the 2nd pension pillar will enter the market in autumn. However, the current economic status that is even too good considering the economic and health situation may have a negative impact on the activity of next years.

Activity is high practically everywhere – in the market of apartments, houses, plots, both in Tallinn and elsewhere. To some degree, the situation has eased – in comparison to February, the sales offering of apartments increased both in Tallinn and Tartu, still remaining lower, however, by over 1000 apartments in comparison to the year before.

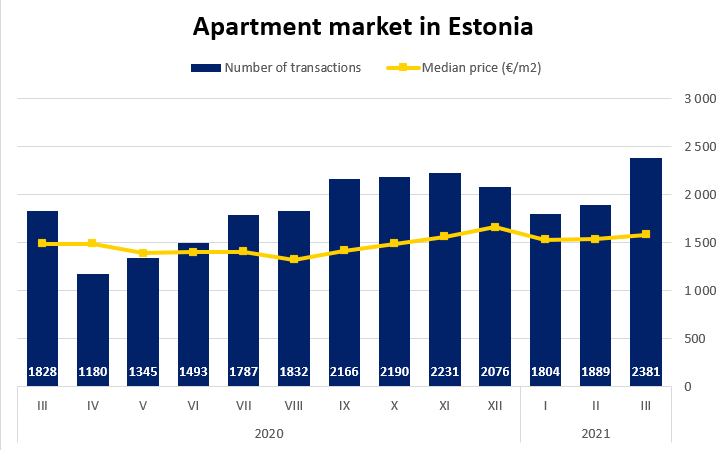

Estonia

2,381 apartment transactions were concluded in March – last time the activity was that high was during the boom when 2,411 apartments exchanged owners in May 2007. High activity could be noticed already at the end of last year where over 2,000 transactions were concluded in four consecutive months, but in comparison to last March over 500 transactions more were concluded. 6,092 transactions were concluded in the first quarter of the year, which is 8.8% more than in the first quarter of last year.

The median price of transactions did not break any records but still crossed the threshold of 1,500 €/m2 for the fifth consecutive month (1,584 €/m2). In comparison to last year, the median price of transactions in the 1st quarter increased by 4.6%. In comparison to the 1st quarter of last year, the number of transactions dropped only in three counties (including by 14 in Lääne County), due to reduced offering, not demand. 247 transactions were concluded in Tartu County (+39%), 124 transactions in Harju County (+3.9%) and 55 transactions in Ida-Viru County (+9.6%). The median price of transactions only dropped in three counties, whereas in Tart County the figure increased by 18.6% due to a large increase in the volume of new developments and by 18.2% in Ida-Viru County, whereas the increase was 3.9% in Harju County and 2.8% in Pärnu County.

In March, over 300 transactions (319) were concluded with private houses, which is a very good result in comparison to the sales of the previous months, as last year, for instance, the threshold of 300 transactions was only crossed twice. When we add 81 transactions with summer houses, we get 400 transactions with private houses and summer houses. In comparison to the same period last year, 230 transactions more have already been concluded. If over 300 transactions a month is already a very good result in the market of unimproved residential land, even 573 transactions were concluded in March and again we must admit that such figures were last reached in 2006.

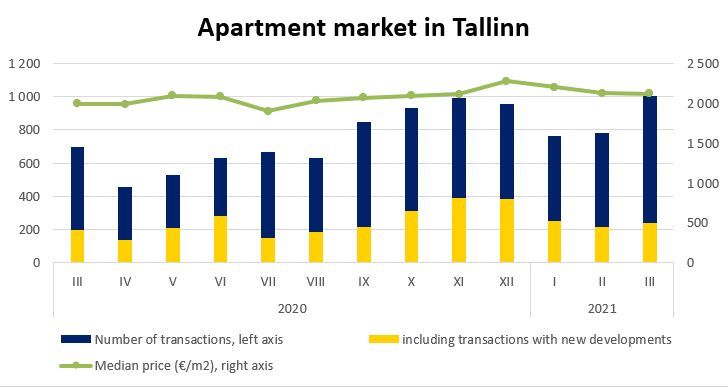

Apartment market in Tallinn

In the 1st quarter of the year, nearly 950 new apartments entered the market, which was the best result after the 2nd quarter of year 2018, and the offering of new apartments was close to 3,500, which was a very good volume of offering. However, that was zeroed out by super high activity, as over 1,200 new apartments were sold during the quarter, which was the best result of the decade and will leave the volume of offering lower than average also in the near future.

1,003 transactions were concluded in Tallinn in March – the threshold of 1,000 transactions was last crossed in May 2007. For the fifth consecutive month, the median price of transactions was over 2,100 €/m2. In comparison to the 1st quarter of last year, the number of transactions has increased by 12.9% and the median price by 7.8%, the reason being a lower share of new developments. Even though 702 transactions were concluded with new developments in the 1st quarter, which was 25 more than last year, rare apartments of the secondary market are increasingly shaping the market. 1,855 secondary market transactions were concluded in the 1st quarter, which was 268 transactions more than during the same period last year.

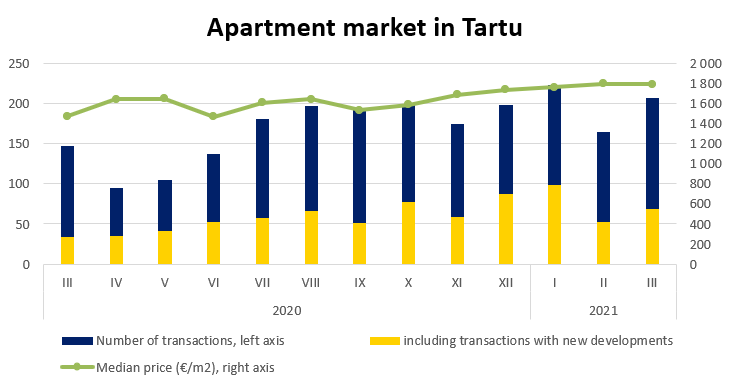

Apartment market in Tartu

In March, over 200 transactions were concluded in Tartu (207 transactions) and the median price was again nearly 1,800 €/m2 (i.e. 1,791 €/m2). In comparison to the 1st quarter of last year, the number of secondary market transactions increased by nearly 70 transactions, whereas the share of new developments in the 1st quarter was 36.7% (24.6% a year ago). Due to an active market of new developments, 44.9% more transactions were concluded in Tartu in comparison to the same period last year, the median price of transactions increased by 20.8%.

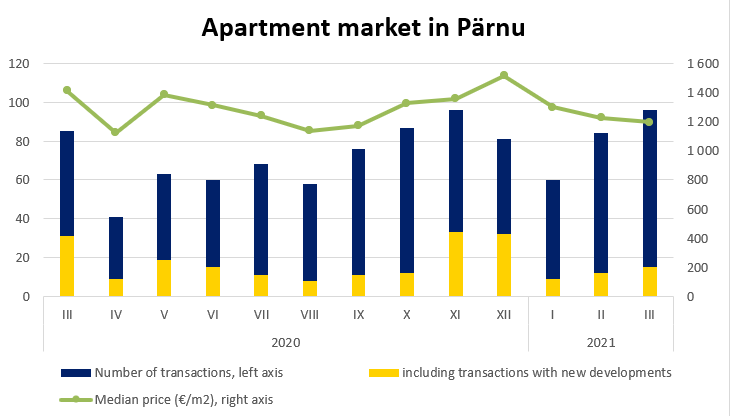

Apartment market in Pärnu

The secondary market was also active in Pärnu where only 36 transactions with new developments were concluded in the 1st quarter (64 transactions during the same period last year). 96 transactions were concluded in March (of which 15 in new developments), which was 11 more in comparison to last year. Doe to a lower share of new developments the median price of transactions was 1,195 €/m2, but when we compare the 1st quarter of this year and that of last year, we can also see signs of a price increase. In comparison to the same period last year, only 4 transactions more were concluded in the 1st quarter (237→241), whereas the median price of transactions remained virtually the same. However, in comparison to the same period last year, 32 transactions more were concluded in the secondary market.

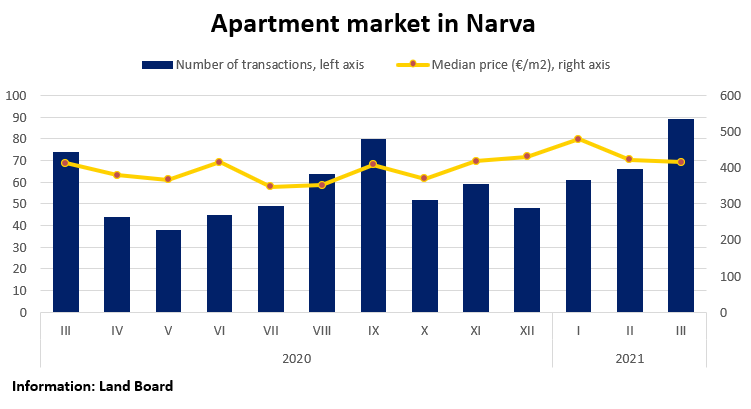

Apartment market in Narva

Regardless of the non-existent market of new developments (Narva) or the reduced share of new developments (Pärnu), the market was active both in Narva and Pärnu. 89 transactions were concluded in Narva, which was the highest number of transactions of all time and a remarkable achievement considering the reduced offering. The median price in March was 415 €/m2. In comparison to the same period last year, the number of transactions Narva has increased by 11.3% and the median price by 4.9%.