The year that ended was turbulent in the real estate market. Various bold predictions were made considering the recess in April some of which came true (growing interest in real estate located in low density area, failure of short-term lease market) and some of which did not come true (a large price drop in the sales market).

As the state benefits continue, we will see low loan interests also in the new year, as well as the desire to facilitate consumption and keep unemployment below the critical level. As money is being printed, the value of property continues to increase, which means that saving is still a “punishable” activity and it is more reasonable to hold positions in the stock market or real estate market. However, people did not remain idle and in December the number of sales offers dropped to the lowest level of the past decade.

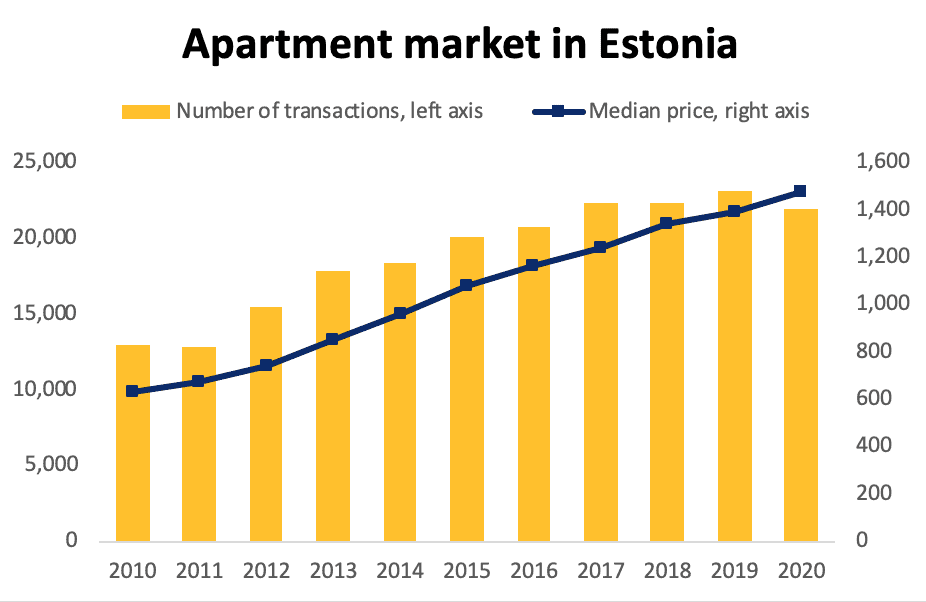

Estonia

In December, over 2000 transactions were concluded in the apartment market in Estonia for the fourth consecutive month (2,076 transactions). Sales volumes were mostly stable but due to new restrictions we saw a larger drop in Ida-Viru County (197→174), as well as Lääne-Viru County (90→47). The median price of transactions broke records (1,663 €/m2), which was influenced by a higher share of new developments as usually at the end of a year.

The total number of apartment transactions during the year was 21,902, which was 5.5% less than in 2019. Last time the number of transactions was that low was in 2016. The median price of transactions, however, increased by 5.8% to 1,474 €/m2.

Sales of houses and summer houses increased by 6% during the year and the trend was prevalent, dropping only in the counties with undersupply of properties. As the pace of vaccination is slow and new virus strains against which there may be no vaccine still cause uncertainty, the interest in buying houses, summer houses and residential plots remains strong also this year.

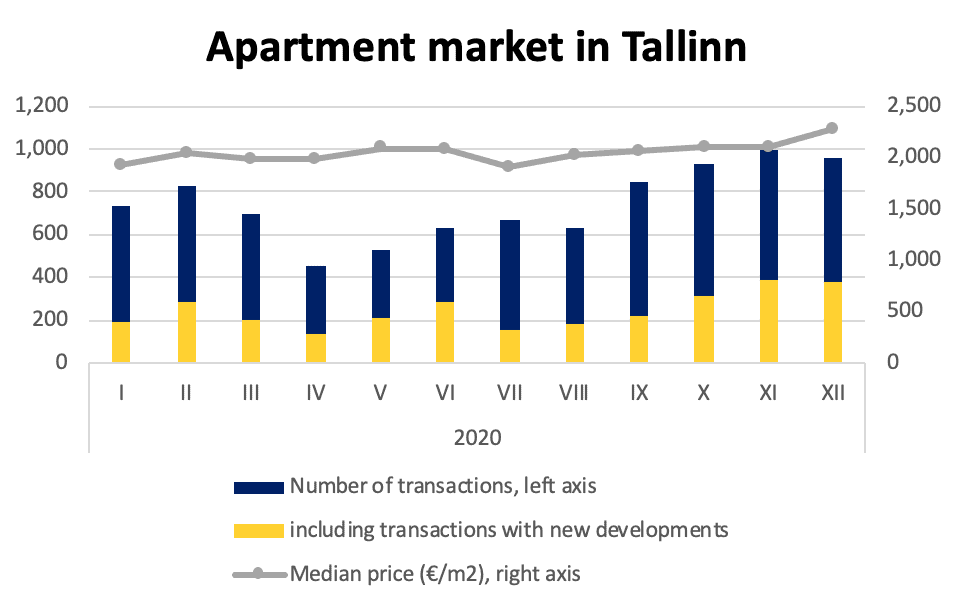

Apartment market in Tallinn

For the third consecutive month, over 900 apartment transactions were concluded in Tallinn. If 993 apartments were sold in November, in December the number was 955. Similarly to November, the share of new developments was nearly 40%.

As typical for the end of year, the share of new developments was larger, which for the first time brought the median price of transactions over 2,200 €/m2 (more precisely to 2,279 €/m2).

In total, the number of apartment transactions in Tallinn dropped by 9% in comparison to year 2019 (9,784→8,900), i.e. for the first time since 2015 less than 9,000 transactions were concluded during the year. Instead of the anticipated price drop we saw an increase by 8.6% (1,893→2,055 €/m2). 150 more apartments were sold in new developments compared to last year (2,787→2,936), whereas we saw a drop of nearly 15% in the secondary market (6,997→5,964). Such a change in the structure brought along an increase in the share of new developments from 28.5% to 33.0% and new price records.

In the year that has begun, due to a drop in the volume of new developments and a drop in the volume of offering in the secondary market, we expect a drop in the number of transactions – next to longer sales periods for new apartments we can also see the triumph of smaller-scale and more expensive developments and continued bold development activities in the surroundings of Tallinn.

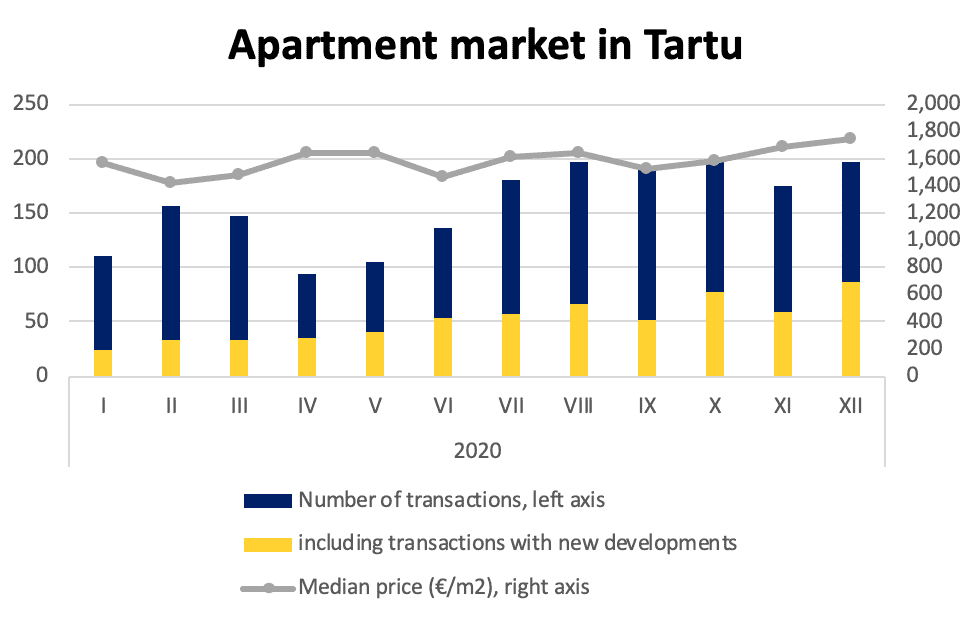

Apartment market in Tartu

The last month of the year was very active also in the apartment market in Tartu – 198 transactions were concluded in December (over 170 transactions for six consecutive months), and for the first time the median price increased over 1,700 €/m2 (more precisely to 1,740 €/m2). The statistics of December were upheld by apartments in new developments with a market share of nearly 44%, whereas over 100 transactions were concluded in the secondary market for the sixth consecutive month.

In total, the strong demand in the second half of year 2020 could not compensate for the drop in spring. The number of apartment transactions dropped by 5.6% (2,011→1,899), however, as a consequence of the volume and price increase of new developments and the price stability in the secondary market, the median price increased over 10% (1,444→1,598 €/m2).

Relying on the increase in the number of building permits issued for apartment buildings, next years promise a continued triumph of new developments.

Apartment market in Pärnu

The market in Pärnu was active at the end of the year. The number of apartment transactions concluded in December was even 81, whereas last December there were less than 50. The large volume is greatly based on the nearly 40% share of new developments, which for the first time brought the median price of transactions over 1,500 €/m2.

In total, the number of transactions in Pärnu dropped only less than 3% (894→870) during the year, whereas in spite of a price drop for typical apartments, the median price increased by 1.5% (1,244→1,263 €/m2) thanks to a slightly higher share of apartments in new developments.

As one of the key words for both last year and the new year is local investment, we expect continued strong demand in the market of the summer capital for more luxurious and interesting properties. Unless the economy and health factors deteriorate, we also expect stable demand for typical apartments and lower-priced properties.

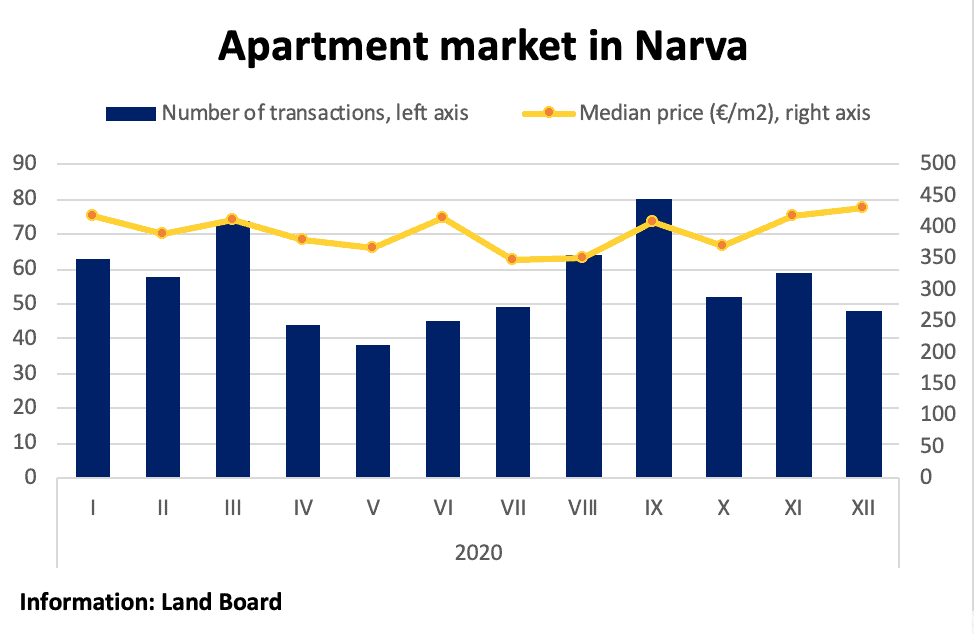

Apartment market in Narva

Tighter restrictions imposed as of December 12th did not impact the market of country houses in Ida-Viru County but had a significant impact on the apartment market. If in November the number of apartment transactions in Jõhvi, Kohtla-Järve and Narva were 24, 72 and 59, respectively, in December the figures were 18, 64 and 48. Out of larger cities, in comparison to November, the number of transactions only increased in Sillamäe.

However, the drop in the number of transactions was not the same for apartments of different size. The number of transactions with larger apartments remained stable in Narva, whereas 11 transactions less were concluded with apartments below 41m2. The median price of apartments sold in Narva even increased (418→431 €/m2).

For the whole year, however, we saw a price increase of less than 3% in Narva (391→401 €/m2). The number of transactions in Narva dropped by 11.3%, which was more than in other larger cities. The number of offers in Narva dropped by a couple of hundred during the year, which is a sign that in the current uncertain situation many people have decided not to sell their apartments.