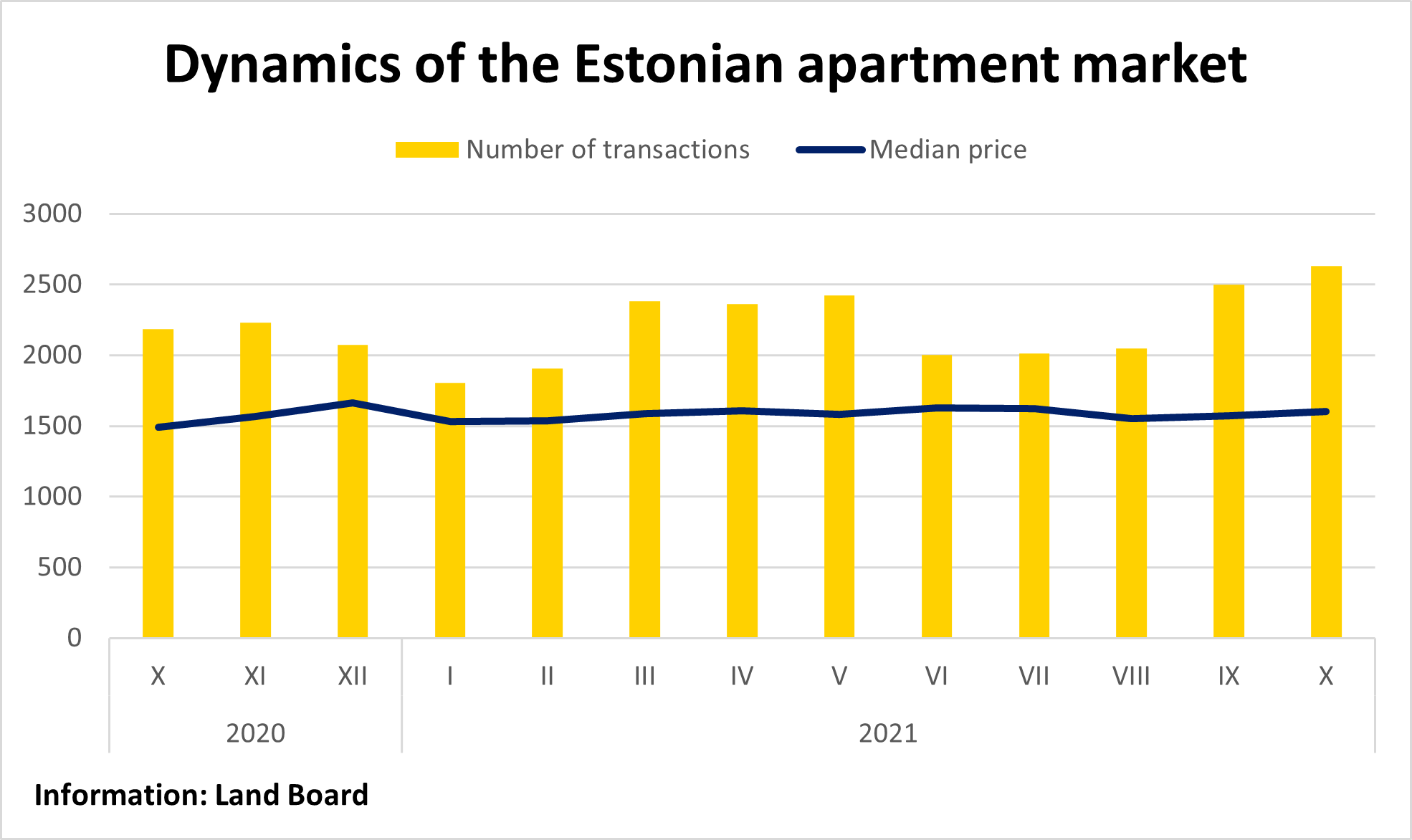

The high tide having started in September due to the influence of payments from the second pension pillar continued in October. 2,633 apartment transactions were concluded all over Estonia, which was the best result since October 2006. In spring when we spoke about a boom, the number of transactions remained around 2,300–2,400, while the number of transactions in September was nearly 2,500.

One of the quickest inflations in the Euro region plus the top position on the leaderboard of coronavirus have not had any negative impact on consumer confidence. On the contrary, the market has remained active – low offering with stable demand and the best loan terms of the decade facilitate purchase of real estate as well as other assets.

The median price of transactions was close to the record, for the fifth time in history, the threshold of 1,600 €/m2 was crossed, the exact number was 1,603 €/m2. Inflation and rapid price increase caused by imbalance between the demand and offering of course play a part here but autumn, especially the pre-Christmas period, is one of the busiest times for completion of new buildings.

Estonia

Significant influence of new developments was first of all reflected in the number of transactions in Harju County – if 1,242 transactions were concluded there in September, in October the number of transactions was 1,359. It was the best result of this year, and the median price i the county – 2,168 €/m2 – was the best result of all time. Based on the first ten months of the year, the median price in Harju County has increased by 7.1%, whereas due to the low baseline of last year, the number of transactions has increased even by 23.3%. Of other larger counties, the number of transactions in Ida-Viru County increased, which may be due to the influence of the pension reform. In September, the number of transactions in Ida-Viru County was 287 and in October it was 325.

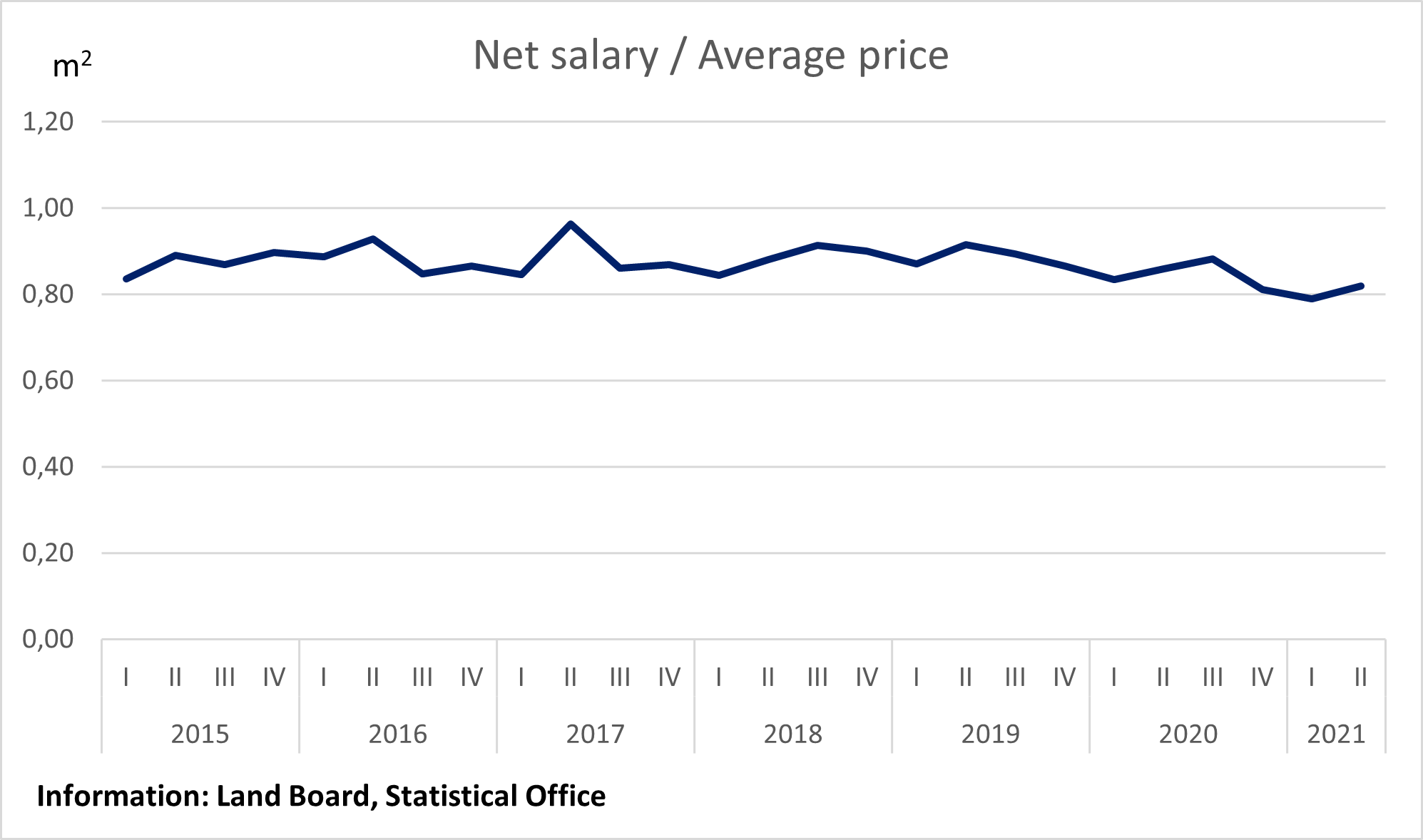

Comparison of salary and price

Even though no drop in demand can yet be seen, it is of some concern that the price of real estate increases quicker than salaries: if salaries have increased by 7.3% in annual comparison (based on the 2nd quarter), the price increase of real estate has been over 10%. The affordability of real estate used to be stable for a while but now it is possible to buy a 0.8 m2 piece of an apartment for the net salary of one month. Even two years ago it was possible to get 10% more of the area, i.e. that is how much affordability of real estate has dropped in past two years.

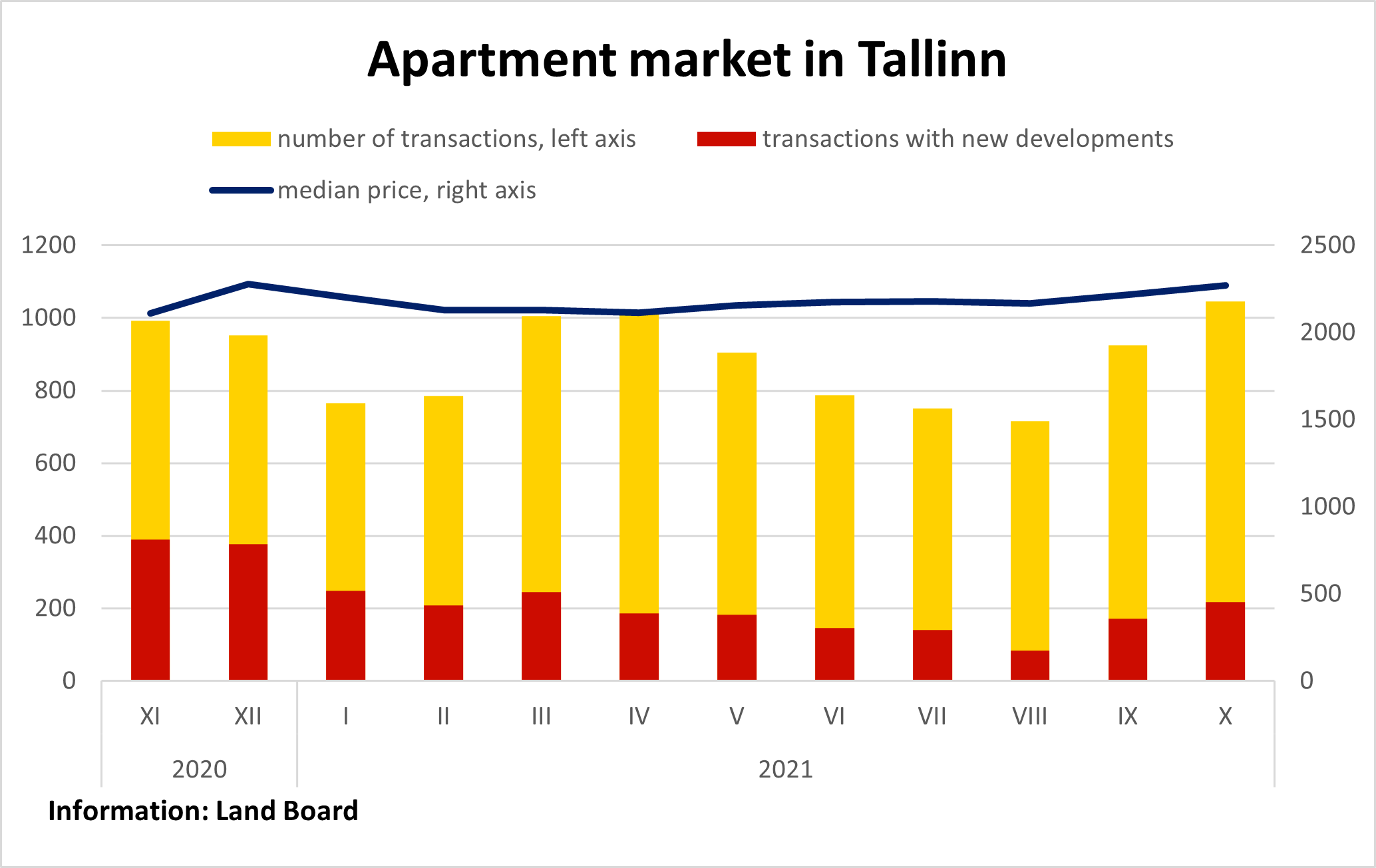

Apartment market in Tallinn

In Tallinn, a significant threshold – 1,000 apartment transactions in one month – was crossed for the third time this year. 1,046 transactions was the highest figure since May 2007. Characteristically of this year, the high number of transactions was supported by the active secondary market with over 800 transactions concluded, whereas 218 transactions were concluded with new developments, i.e. nearly 21% of the total number of transactions.

Increased input prices and low offering took the median price of transactions close to the record level – 2,271 €/m2 was only inferior to last December but back then the share of new developments was nearly 40%.

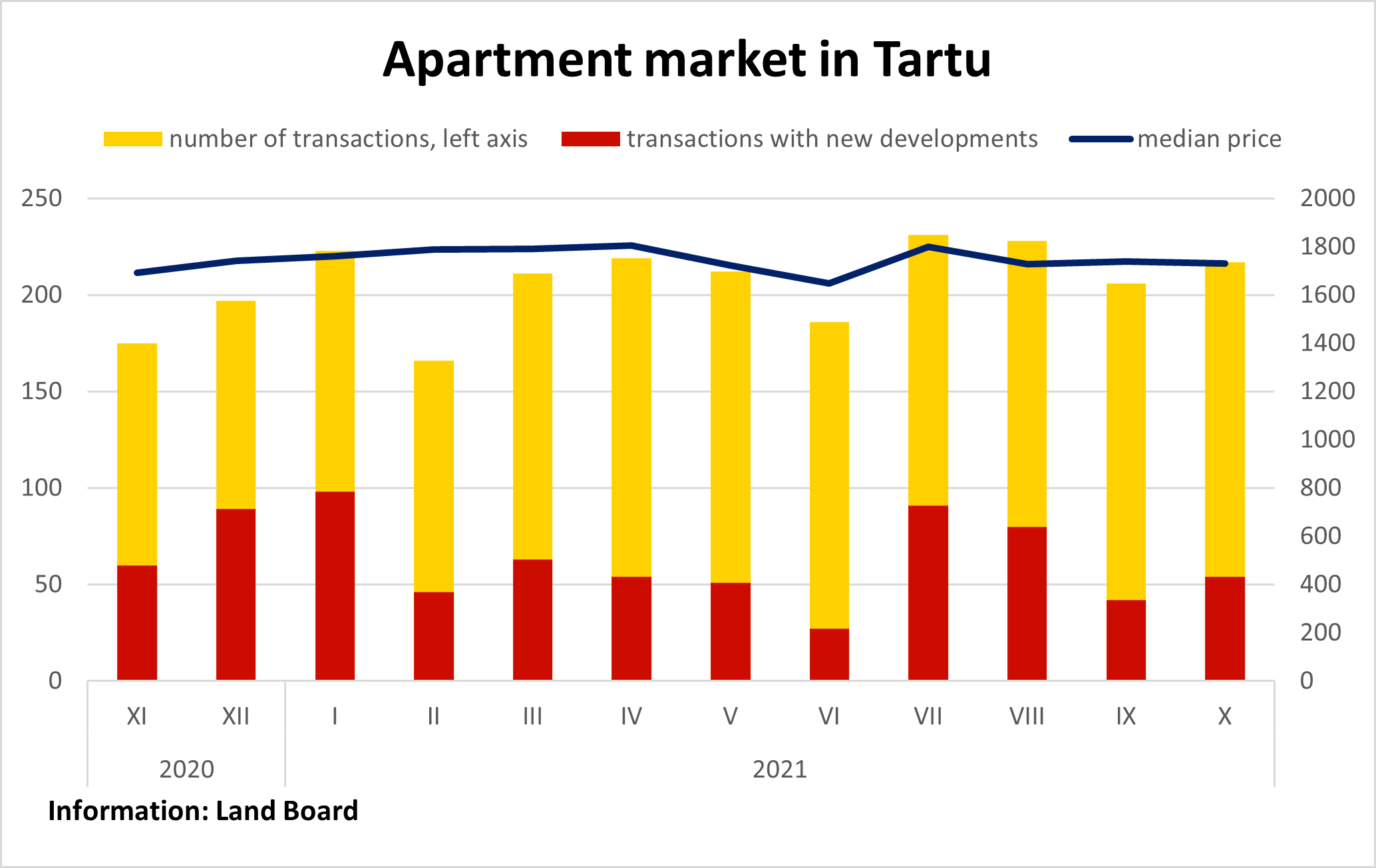

Apartment market in Tartu

For the eighth time this year, at least 200 transactions were concluded in Tartu, whereas the sales numbers of apartments in new developments were somewhat lower due to the planning of construction works – in October, 54 transactions were concluded with new buildings, whereas the average figure for the year is 61 transactions. On the other hand, the activity of the secondary market is one of the highest of all time. If earlier the number of transactions in secondary market in Tartu has been up to 120, in September and October the number of transactions was over 160. The median price of transactions was similar to three previous months, remaining at 1,730 €/m2.

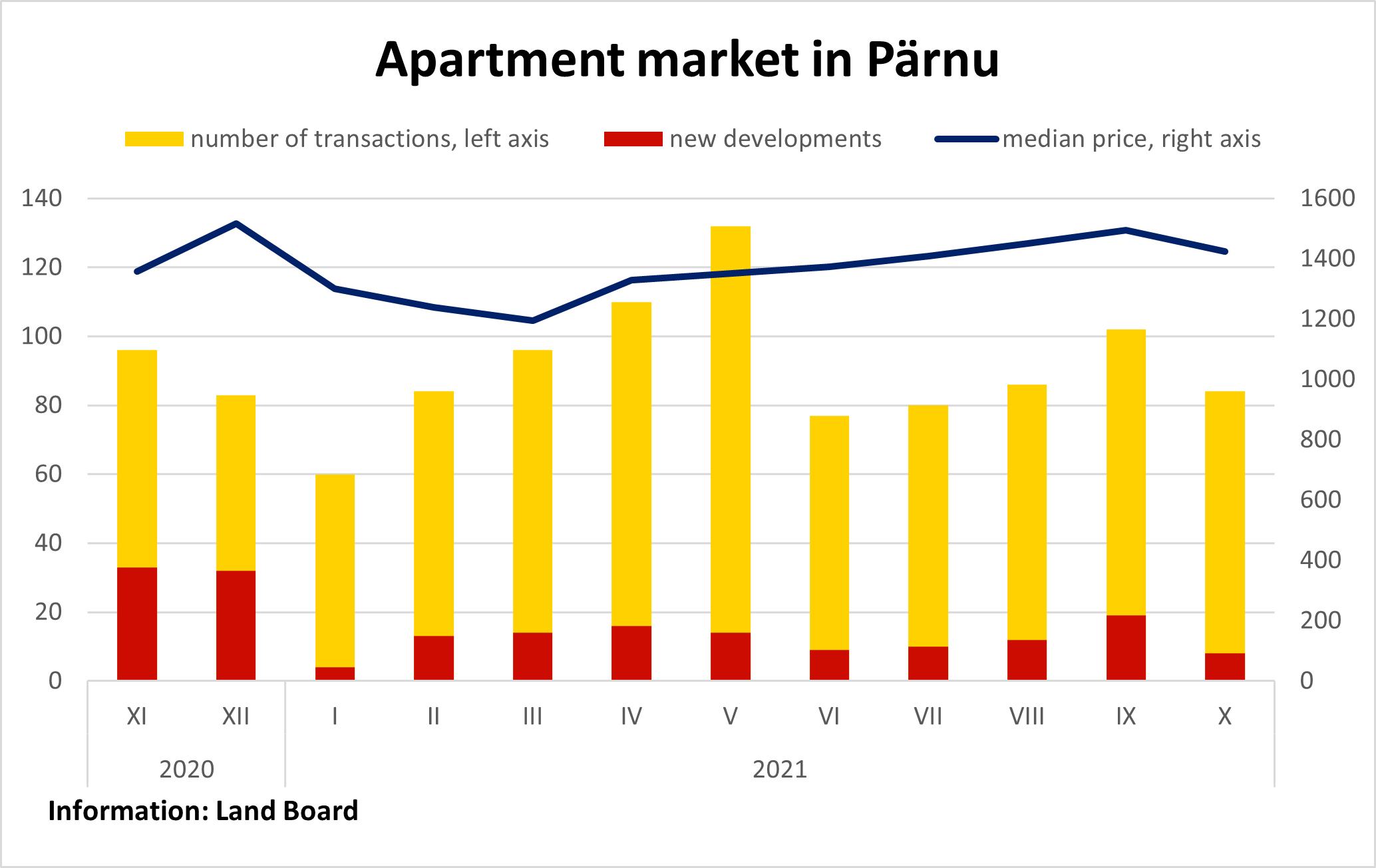

Apartment market in Pärnu

84 transactions were concluded in Pärnu in October, which was less than in September, but looking at the activity of the secondary market it cannot be said that the market has dropped in any way. Only 8 transactions were concluded with new developments, which was nearly the lowest result of the year, whereas the activity of the secondary market remained at the average level of the year.

Due to the low share of new developments, the median price of transactions was 1,424 €/m2, which means that the median price exceeded the threshold of 1,400 €/m2 for the fourth consecutive month but was lower than the results of August and September.

Apartment market in Narva

In Narva, with the support of the pension reform, the activity of the market has clearly increased in the past two months. It is rather logical, as 32% of the people having joined the second pension pillar took out their funds, which was the highest result among the counties in Estonia.

If earlier nearly 70 apartment transactions had been concluded in Narva in the best months, in September the number of transactions was 98 and in October 110, the latter being the record-breaking result of all time.

The quick increase in the number of transactions and the short-term increase in the deposits of people significantly increased the median price in the environment with low offering – if previously the median price in Narva has remained around 400 €/m2, in October it increased to 500 €/m2. Time will tell whether it is a temporary phenomenon or really a new price level.

Houses and summer houses

Autumn is a calmer period in the market of houses and summer houses. In September still 449 transactions were concluded, in October, however, the number of transactions was 407. In comparison to the same period last year, 51 transactions more were concluded.

Similarly to the apartment market, the activity in the market of houses is not bad, but in a smaller and less liquid market such fluctuations are more frequent. The market of unimproved residential land has also calmed down – if in spring the number of transactions in a month occasionally exceeded 500, in September the figure was 391 transactions and in October 269 transactions.