The real estate was active also in May – some think it is a boom, others find that it is simply a situation where statistics are boosted by transactions postponed last year; whatever the opinion, it is a fact that we have not seen such high results since spring 2007.

As the restrictions are lifted, the focus of people is increasingly directed at private consumption, and probably starting from midsummer, the market will be somewhat calmer due to the holiday season and potentially also the hotter-than-average summer. However, in autumn we will see restored activity and possibly also exceeding of the spring results, especially if the funds that will become available with the pension reform is directed more to assets than private consumption.

There is a rule on the real estate market saying that prices usually react to the number of transactions with a delay. The high number of transactions has brought along a price increase, which means that looking at the current high activity it is difficult to imagine that prices should drop in the near future. A quick increase in the prices of construction materials and the new high tide of autumn activity will push the prices up even more, even though for the summer, based on the lower activity, it could be presumed that the indicator would remain rather stable.

Estonia

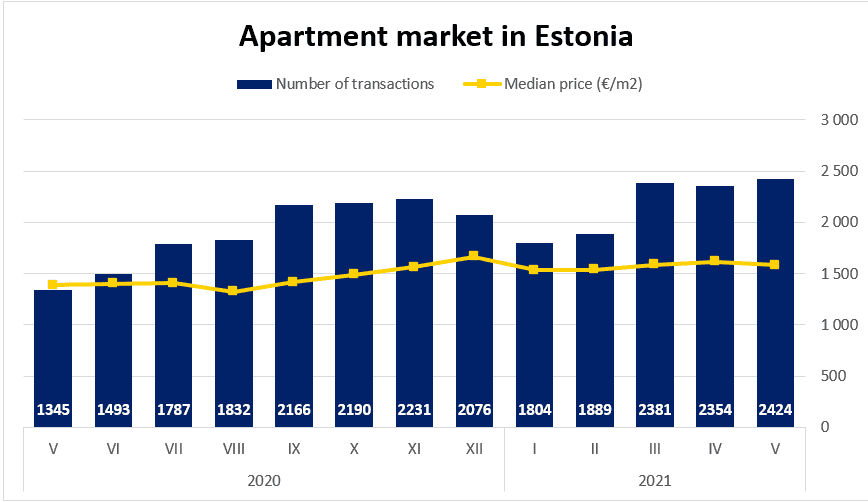

All over Estonia, over 2,400 apartment transactions were concluded in May, which was even more than in March (2,381 transactions) and April (2,424 transactions). As for the counties, the most active ones were the largest counties – 1,261 transactions were concluded in Harju County (1,313 in April), 326 transactions in Tartu County (311), 244 transactions in Ida-Viru County (213) and 180 transactions in Pärnu County (135).

A price increase characteristic of an active market is obvious all over Estonia – the median price of transactions in May was 1,618 €/m2, and in the first five months of this year, the median price of transactions has increased by 6.5% (1,471→1,566 €/m2). The only counties where the median price has dropped are Hiiu, Rapla and Valga counties, but here the cause lies in the structure of transactions rather than in an actual price drop. In comparison to the same period last year, the number of transactions has increased by 33.9%, and by 16.3% in comparison to year 2019 when the market situation was normal.

Apartment market in Tallinn

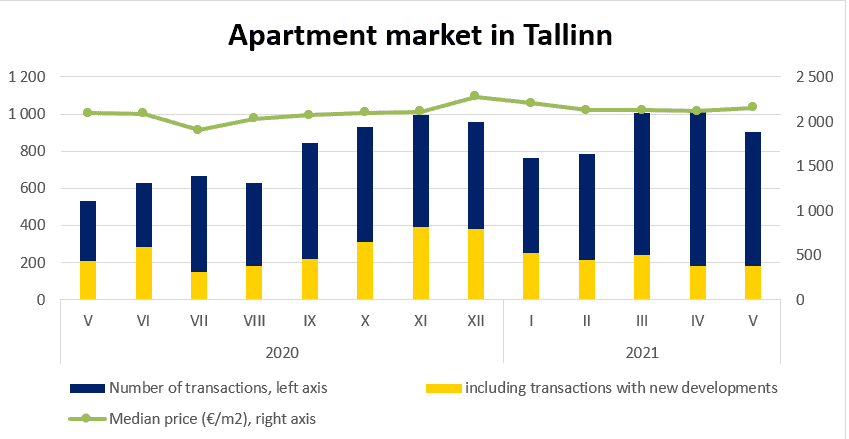

In May, 903 transactions were concluded in Tallinn, and in comparison to March and April with over 1000 transactions the market calmed down. 180 transactions were concluded with new developments, which was virtually as much as in April, but regardless of an increase in the offering, 723 transactions (i.e. over 100 transactions less than in April) were concluded in the secondary market. In spite of the drop, the month was still very active, but only time will tell if the people who postponed their apartment purchases last year have already compensated that by the high number of transactions.

For the seventh consecutive month, the median price of transactions was over 2,100 €/m2 (2,155 €/m2) – in comparison to the first five months of last year, the median price has increased by 6.9% and the number of transactions by 37.8%.

Apartment market in Tartu

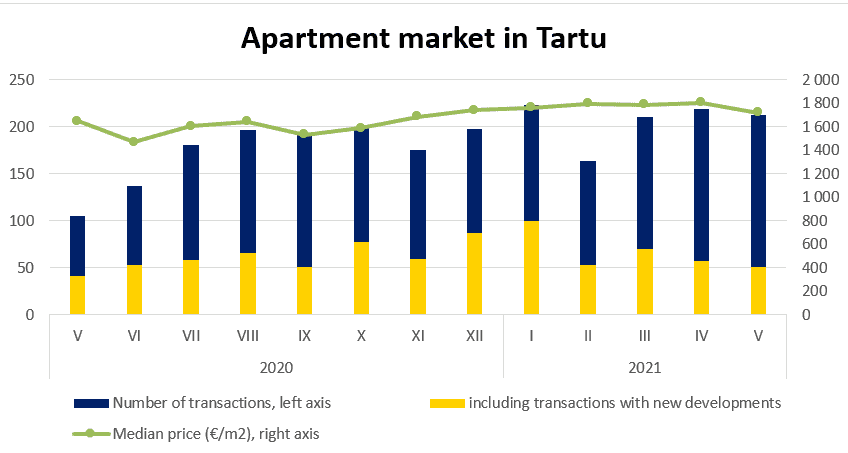

In Tartu, over 200 transactions were concluded for the third consecutive month (213 transactions), the median price of transactions was over 1,700 €/m2 for the sixth consecutive month (1,723 €/m2). As for new developments, May was a little slower, only 51 transactions were concluded, but that was compensated by the secondary market where 162 transactions were concluded (the same number as in April) – usually there are around 120 secondary market transactions a month in Tartu. In the first five months of the year, the market of Tartu has been one of the fastest growing ones in Estonia – the number of transactions has increased by 67.8% (615→1,032) and the median price by 17.5% (1,511→1,776 €/m2).

Apartment market in Pärnu

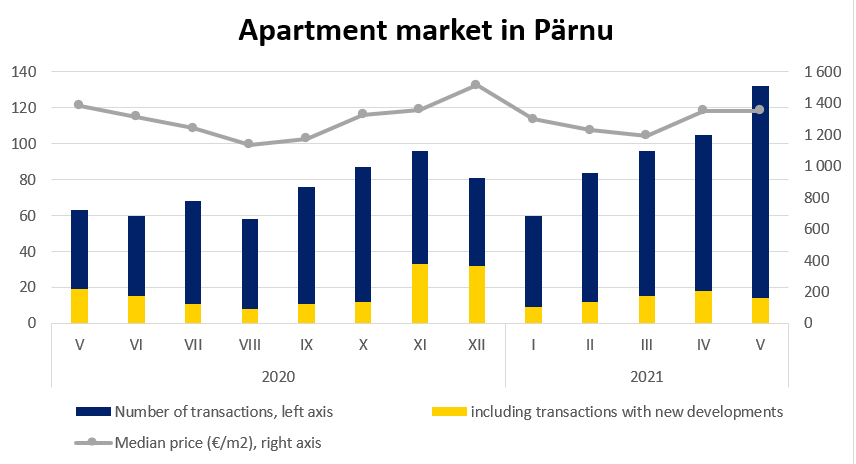

As a result of an extremely active secondary market, also Pärnu reached the best result of the recent years. If only 14 transactions were concluded with new developments, the number in the secondary market was even 118, whereas the top total number of transactions in the recent years was in May 2019 with 115 transactions. Regardless of the high share of secondary market apartments, the median price of transactions was very high – 1,352 €/m2. In the first five months of the year, the number of transactions has increased by 39.7% (345→482) and the median price by 1.8% (1,272→1,296 €/m2).

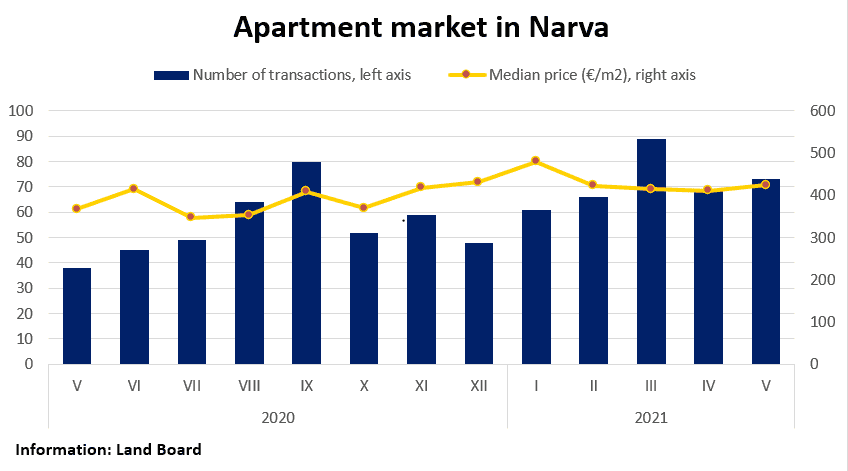

Apartment market in Narva

The slowest growth could be seen in Narva, as the support of new developments is missing there. However, in comparison to the same period last year, the number of transactions has increased by 29.7% (276→358) and the median price by 6.1% (403→428 €/m2). Based on the current data, 73 transactions were concluded in May with a median price of 424 €/m2.

Good times on the market of houses and summer houses continue – the sky-high result of April (482 transactions) was beaten in May with 538 transactions concluded. 392 transactions were concluded with houses (123 of those in Harju County) and 146 transactions with summer houses (61 of those in Harju County). In the first five months of the year, 1,976 transactions were concluded with houses and summer houses, which is 683 (52,8%) more than during the same period last year.

The increase in the number of transactions has been extensive, even though the greatest attention has been paid to the areas near the largest magnets and bodies of water.

We cannot complete the overview without mentioning the market of built-up residential land, which regardless of its relative invisibility has shown the quickest growth across various segments. If the annual increase in the number of transactions on the apartment market was 34% and on the market of houses / summer houses 53%, on the market of plots the number of transactions has more than doubled – 1,085 transactions were concluded in the first five months of last year; this year the number is 2,449 transactions already. Real estate agents also confirm that as for requests, plots near magnets or in a naturally beautiful location are nearly as popular as equal built-up plots.