The war between Russia and Ukraine has brought some changes to the real estate market, even though its impact on the sales-purchase transactions in March was not too great. Bigger changes have taken place on the market of Tallinn, which is always the first one to respond, whether the news is positive or negative.

In the rental market of Tallinn, the number of offers has dropped by about 40% in the past few months, the price level has increased by 10% to 20%. The risk level in the rental business has increased: the number of people with unknown background and with no history in Estonia has increased tremendously. Thus, next to good Samaritans, a number of distrustful people have emerged, which makes it difficult to let apartments to the refugees, or people want to manage rental-related risks (indefinite rental agreements, guarantees).

The sales-purchase market has also become less active, as consumer confidence is lower and risks of availability of funds have increased – in the second half of the year, the potential of seeing a positive EURIBOR is greater than ever before, which makes loans and servicing of loans more expensive.

In addition to the more negative sentiment, it is difficult to see the possibility to keep the high transaction activity with low offering. Therefore, unlike in the rental market, we have seen an increase in the number of offers in the sales market – there are more people who sell to keep liquidity or go for panic sales. The number of apartment offers that was around 2,000 in Tallinn at the beginning of the year has increased to 2,200 to 2,300 in March and April. Due to a risk of an increase in interest rates, the number of refinancing cases of loans has also dramatically increased. An increased number of offers and a decline in activity might point at a correction of sales prices, but in a situation where many new developments have been halted due to increased prices of raw materials and no problems seem to threaten the macro economy, the prices on the market may not drop.

Estonia

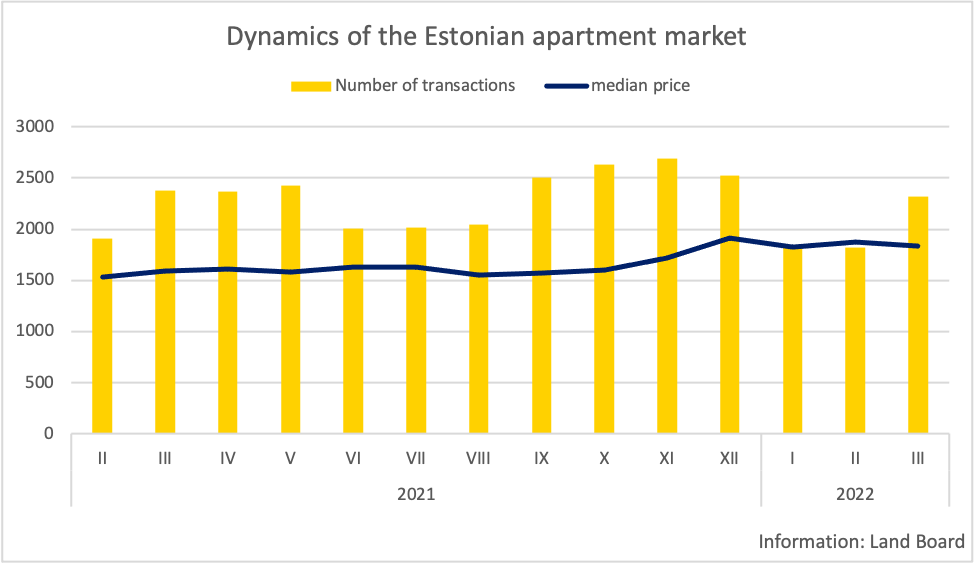

The results in March on the apartment market were remarkably good thanks to agreements concluded in previous months – 2,314 sales-purchase transactions of apartment ownerships were concluded in Estonia, which was a few percent less than during the same period last year, but considerably more than the 1,800+ transactions in January or February. During the first three months of the year, the number of transactions has dropped by nearly 2%. The median price of transactions was 1,837 €/m2, which remained at the level of the previous months; in comparison to last March, the median price increased by 16% (+18.5% in annual comparison of the 1st quarter). Based on the transactions of the 1st quarter, the number of transactions decreased in annual comparison, -6% in Harju County, -4% in Tartu County and -1% in Pärnu County, whereas the number of transactions in Ida-Viru County increased by 11%.

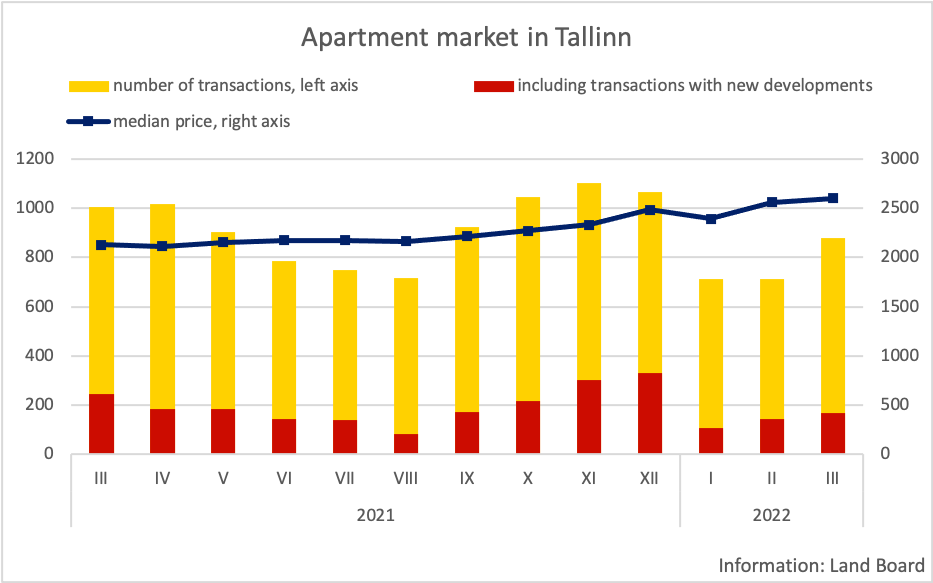

Apartment market in Tallinn

The impacts of the war were more noticeable in the results of Tallinn. 879 transactions were concluded in March (-12.5% in comparison to the same period last year), the number of transactions on the secondary market dropped by 6.4%, whereas the activity with new developments resulting in transactions is still very high. On the secondary market, however, we have seen a nearly 15% increase in the number of offers in comparison to the past two months. Thus, the signs are still rather confusing, but there has been no significant decline in activity. Regardless of the increased number of offers, there is no reason to hope for a price drop in the situation where the input prices rapidly increase. The median price of transactions was the highest of all time in March, reaching nearly 2,600 €/m2 (+22% in comparison to the same period last year). In comparison to the 1st quarter of last year, the number of transactions dropped by 10%, the median price increased by 17%, and the turnover remained about the same.

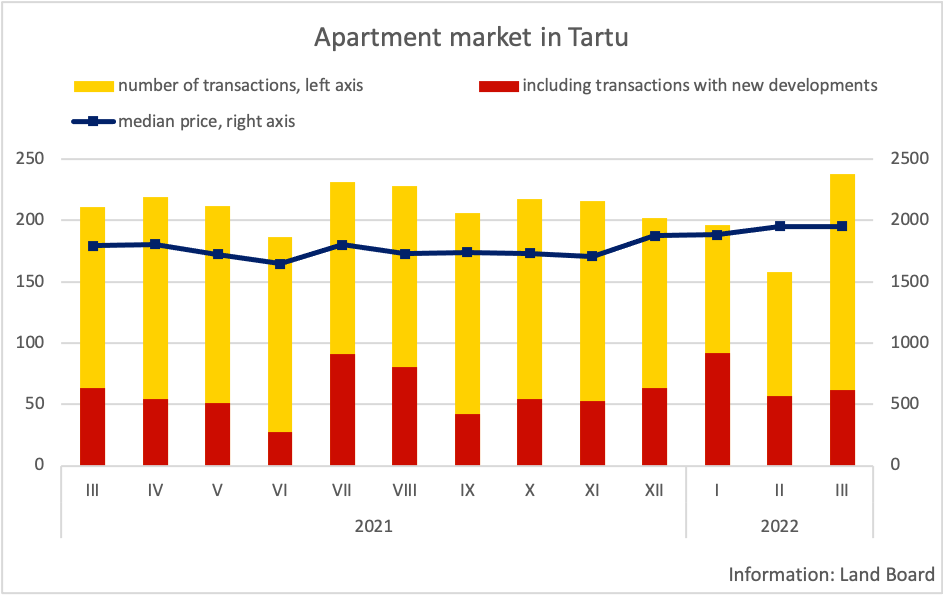

Apartment market in Tartu

Unlike Tallinn, the market of Tartu continued at a very high level of activity. However, also past patterns have shown that in comparison to Tallinn, the rest of Estonia responds to events with a delay. Unlike in Tallinn, also the real estate offering has not increased. 238 transactions were concluded in March, which was nearly a record-breaking result and exceeded the figure of last year by 27 transactions. Thereby, the growth came from the secondary market, as 62 transactions were concluded with new developments, which was about as much as last year. The median price of transactions in March was 1,950 €/m2, which was only slightly less than that of February (1,952 €/m2) but in comparison to last March, the price level increased by nearly 9%. In comparison to the 1st quarter of last year, the number of transactions was about the same, the median price increased by 9%, and the turnover about 10%.

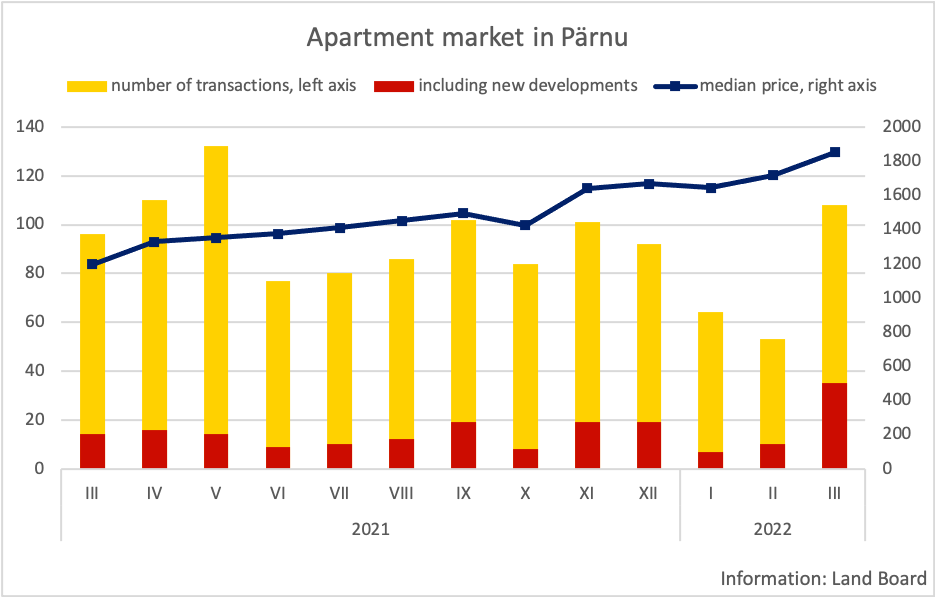

Apartment market in Pärnu

Thanks to the volume of new developments that was rather high for Pärnu (35 transactions), over 100 transactions were concluded, even though the number of transactions in the secondary market dropped by 9 in the comparison of years. Changes in the structure of transactions resulted in a rapid price increase (+55% in the comparison of years), the median price of transactions broke another record, reaching 1,853 €/m2 (1,696 €/m2 in the secondary market). In the comparison with the 1st quarter of last year, the number of transactions this year still has dropped by 6% (secondary market -17%), but the median price of transactions has increased by 40% and transaction turnover by 37%.

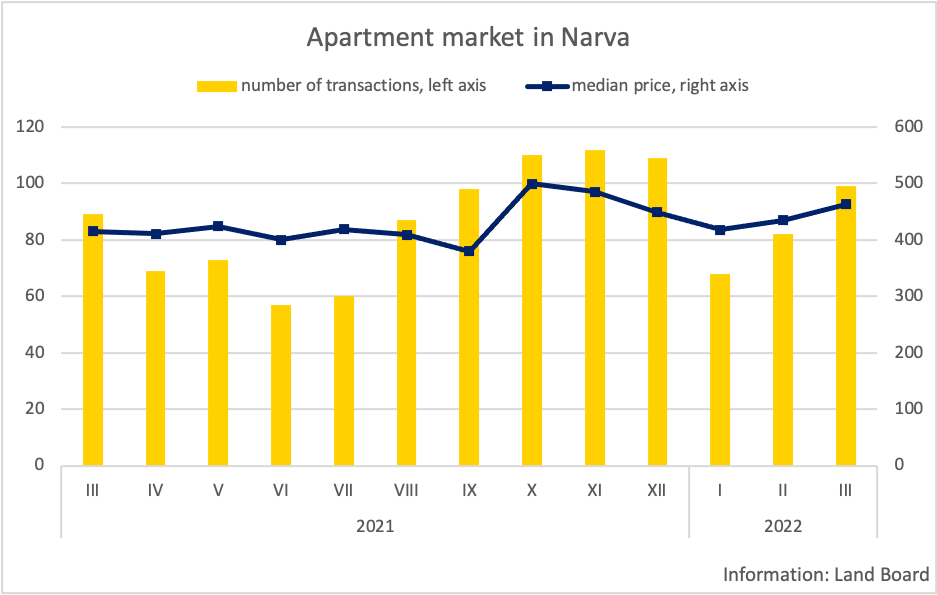

Apartment market in Narva

March was a very active month in Narva, 99 transactions were concluded, which was 17 more than in February and 10 more than during the same period last year. Due to low offering and high demand, the median price of transactions has gradually increased, in the 1st quarter, the median price was 449 €/m2 (+4% in the comparison of years), the number of transactions during the same period has increased by 15% and transaction turnover by 23%.

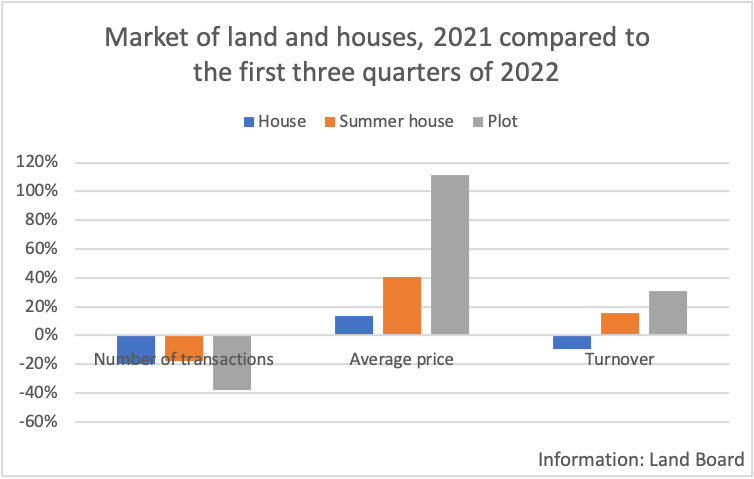

The market of houses and summer houses

The market of houses and summer houses was influenced by the rapid increase in energy prices and construction prices. In March, 237 transactions were concluded with houses and 56 transactions with summer houses, which was better than the result of January and February, the number of transactions was 28% lower than last March. When comparing the first three months of this year, the number of transactions was 19% lower than last year, and even though the average sales price of houses has increased by 13%, the turnover has reduced due to a larger drop in the number of transactions. A similar trend can also be observed in the market of plots where the number of transactions has dropped, but the price level has quickly increased.