For the real estate market, year 2022 began with an energy shock. That has not brought along a price drop but has increased the number of sales and lease offers.

Due to the large volume of new developments, the asking price has rather increased, but the growth in the number of listings implies longer sales periods, and in the next six months (especially for the secondary market) also more stable transaction prices. In the short term, the oppressive side costs first of all impact the lease market, a price correction may take place, but it is difficult to make long-term predictions based on one-two months.

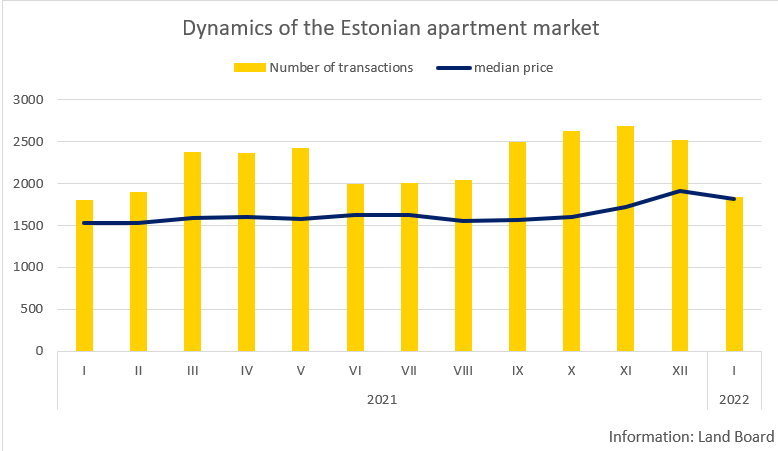

Estonia

It is more likely that the real estate market is in for a calmer period than was offered by last year. Expectations to the increase in interest rate depend on political decisions, but if it happens, we will see cooling of the market and deceleration of price increase. The increased number of offerings of new developments most of all in Tallinn is estimated to bring focus from the secondary market to new apartments, and therefore it is predicted that the rapid price increase of the secondary market will slow down. Also, the end of the corona pandemic, stabilisation of the prices of raw materials and reduced number of problems in the supply chain might imply that the market is cooling down, but at turbulent times it is difficult to make such predictions.

As for transactions, we are still on top of the curve, even though the economic growth adjusted downwards due to rapid inflation and a potential increase in the interest rate rather bring negative sentiment to the market. 1,847 sales-purchase transactions of apartment ownerships were concluded in January 2022. One year ago, the number of transactions was 1,804, but the growth in the median price was still rapid – last year, the median price of transactions was 1,532 €/m2, this year it was nearly 20% higher, i.e. 1,822 €/m2.

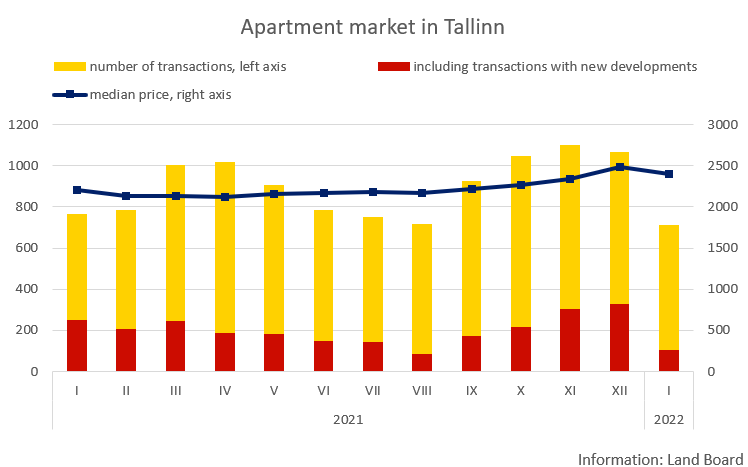

Apartment market in Tallinn

The tendency of detached houses is similar to that of the apartment market – the peak number of transactions was reached last year, and this year we will see a similar or lower number of transactions. 206 transactions with detached houses were concluded in January (226 last year) and 46 transactions with summer houses (50 last year). 235 transactions were concluded with plots of residential land (254 last year).

In lager cities, the transaction activity remained at the level of last year. In the market of Tallinn, however, the number of transactions dropped to 711 (766 last year). The drop was based on new developments, there were only 106 first sales, whereas last year the number was 248. The secondary market was continually active with 605 transactions in January (576 last year). Regardless of a lower share of new developments, the median price exceeded the threshold of 2,300 €/m2 for the third consecutive month, increasing by 8.8% in comparison to the same period last year (2,279 €/m2→2,394 €/m2). As the volume of new developments will increase this year, there are prerequisites for a drop in the activity in the secondary market, but we will see a rapid price increase also this year.

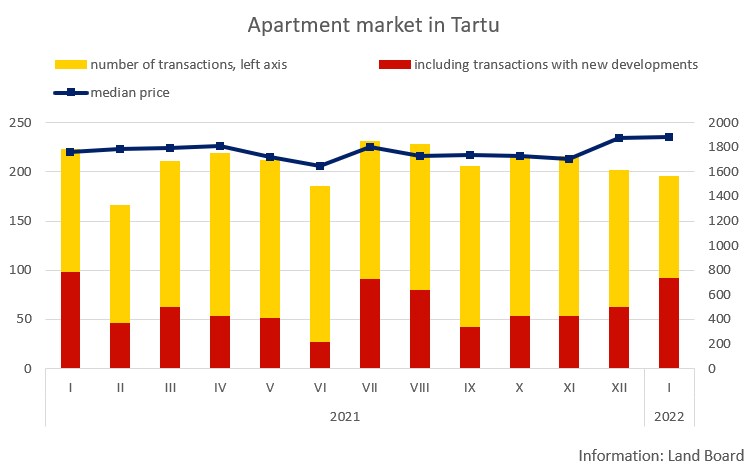

Apartment market in Tartu

196 transactions were concluded in Tartu (223 last year), the drop was based on the secondary market, as over 90 transactions were concluded with new developments in both months compared. A larger share of new developments, rapid inflation and low offering meant that the median price was over 1,800 €/m2 for the second consecutive month, and a new price record was born. In comparison to the same period last year, the median price increased by 6.9% (1,762 €/m2→1,883 €/m2).

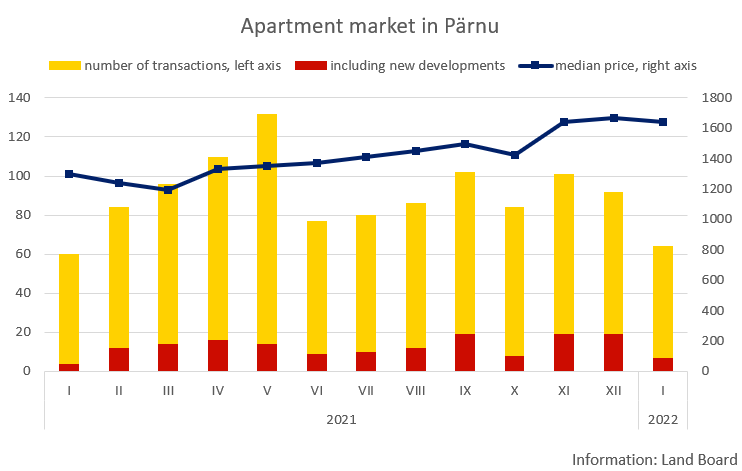

Apartment market in Pärnu

64 transactions were concluded in Pärnu (60 last year), only 7 transactions were concluded with new developments. The median price of the transactions was over 1,600 €/m2 for the third consecutive month; in comparison to the same period last year, the median price increased by 26.4% (1,300 €/m2→1,643 €/m2).

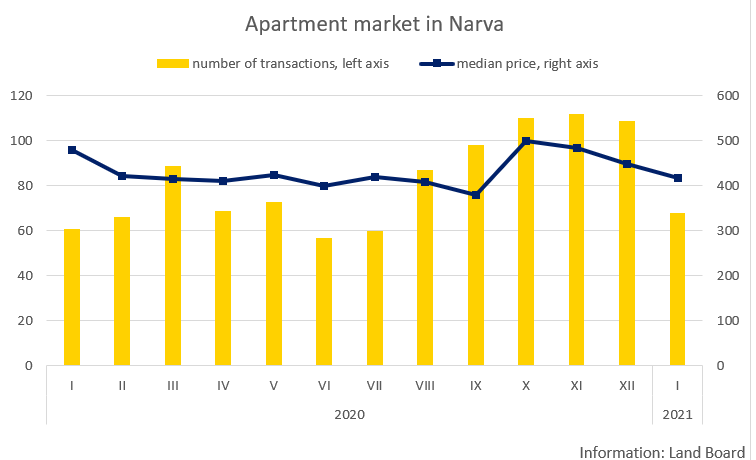

Apartment market in Narva

68 transactions were concluded in Narva (61 last year). As in last January, due to the structural changes, the median price in the border city was even 479 €/m2, this year it dropped back to the normal level of 418 €/m2. Due to low offering, we will see a price increase also this year, whereas the number of transactions may be lower than last year. Especially considering that the effects of the II pension pillar reform remained in the last year.