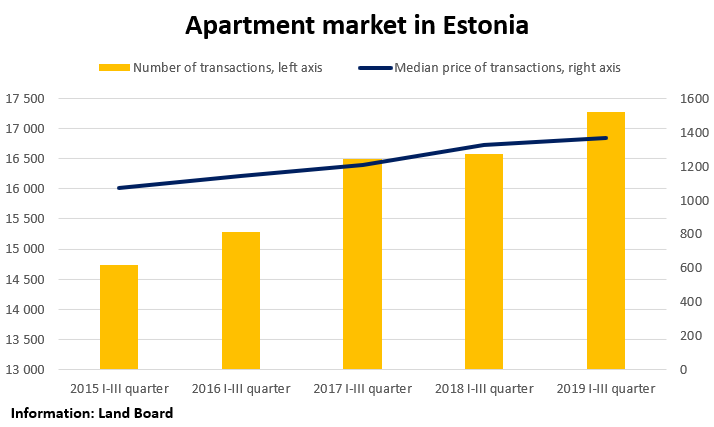

2096 sales-purchase transactions of apartment ownerships were concluded in September. Even though according to common logic September seems to be a rather quieter month, as it is associated with the end of summer holidays and the beginning of school, the reality is far more pragmatic and transactions previously agreed are carried out regardless of new obligations. Thus, in spite of all the presumable obstacles, September was a very active month, as at least 2000 transactions were completed only in two previous months this year. The median price of the transactions remained at the average of the year (1,351 EUR/m2), and during the first nine months of the year, the number of transactions increased by 686 (i.e. 4,1%) in comparison to the same period last year; the median price of transactions has increased by 3% to 1,368 EUR/m2.

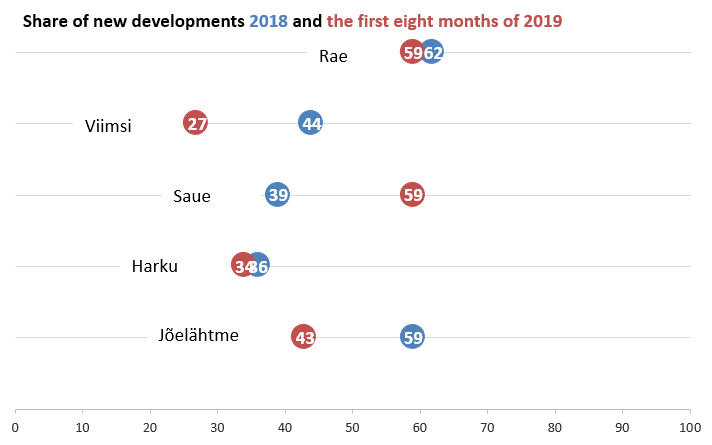

This year has shown that the counties have conquered the fall of last year (the number of transactions has dropped only in four counties). However, in the longer term the number of transactions only grows in areas with stable or growing populations and active markets of new developments. Accordingly, the highest risers of the year, with one exception (Ida-Viru County), have been associated with new developments – the number of transactions in Pärnu County increased by 97, in Tartu County by 162 and in Harju County by 223. The biggest increase in the number of transactions, however, took place in Harju County outside Tallinn (+191 compared to the first nine months of last year), which is also characterized by a rapid price increase – in the first three quarters of year 2017 the median price was 1,191 EUR/m2, in 2019, however, it was 1,484 EUR/m2, i.e. higher by nearly 25%. The number of transactions, however, has not widely increased – out of the 15 municipalities outside Tallinn, the figure only increased in seven municipalities; however, only one municipality contributed to the growth to a significant degree. In the first nine months of last year, 245 transactions were concluded in Saue Municipality; this year the number was 468 – nearly twice as much. It means that the market of new developments in Harju County is experiencing a slight decline this year; however, the market share outside Tallinn has increased. Out of the other larger municipalities, the number of transactions increased in Viimsi Municipality (236→274) and Lääne-Harju Municipality (160→210), in Rae Municipality the number of transactions was stable (428→423) and it dropped in Harku Municipality (148→124) and Maardu Town (165→136). Looking at the current developments, however, it seems that the larger development activity will move from Saue Municipality to Harku Municipality in the next years.

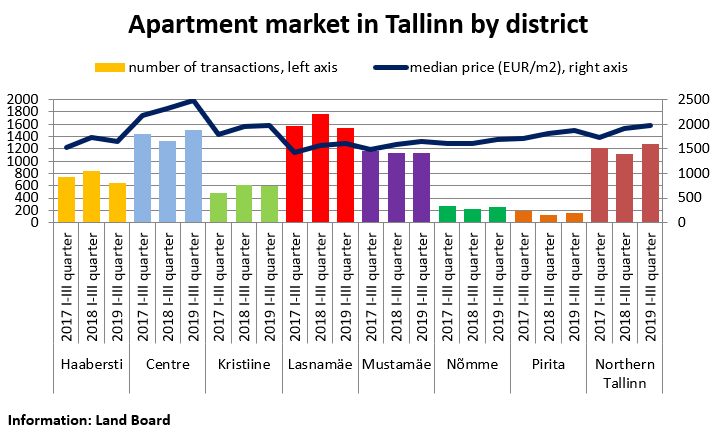

In Tallinn, 830 transactions were concluded in September, and the growth in the number of transactions in comparison to past months refers to the fact that the most active period of the Tallinn market is arriving with the largest number of new developments to be completed. September was only inferior to May this year. The median price of transactions in September was 1,853 EUR/m2, remaining at the average figure of the year. In the first nine months of the year, 7,132 transactions were concluded in Tallinn, i.e. 32 less than last year, which makes it one of the few areas in Estonia where the number of transactions has dropped in comparison to the same period last year. As to districts, in comparison to the same period last year, the number of transactions has increased most in the Centre (1331→1512) and Northern Tallinn (1118→1283), whereas a larger decline has taken place in Haabersti (839→650) and Lasnamäe (1770→1534). However, the last quarter of this year will probably even the differences out.

The growth in the median price of transactions, however, has been rapid. A reduced number of new developments and continued salary increase have made it possible for developers to keep the stock absorption rate high regardless of the higher prices. The median price of the first nine months of the year was 1,856 EUR/m2, last year it was 1,749 EUR/m2, i.e. in one year the price level has increased by about 6%. Out of the districts of Tallinn, Haabersti was the only one where the median price of transactions dropped, as the share of transactions with new developments was smaller there in comparison to the same period last year. The only district with a median price of over 2,000 EUR/m2 was the Centre (2,481 EUR/m2), followed by Northern Tallinn (1,982 EUR/m2) and Kristiine (1,979 EUR/m2).

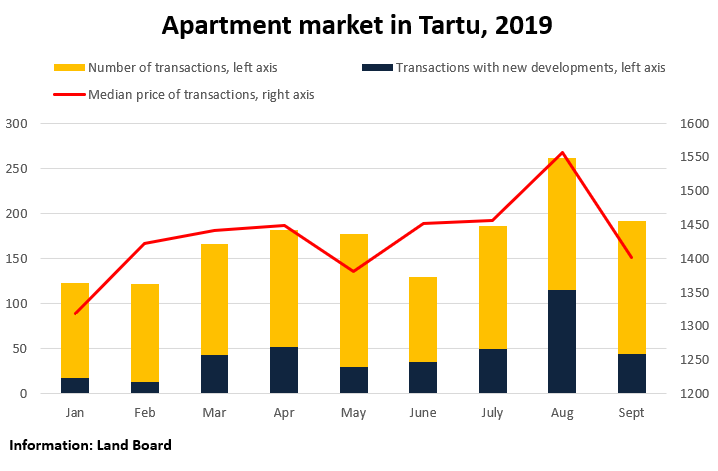

In comparison to the record-breaking August, September in Tartu was more ordinary in many ways; however, thanks to the active secondary market with the largest number of transactions this year (i.e. 148 transactions), it was more active than the average in Tartu. 44 transactions with new developments were concluded, most of which in Riia district. However, the smaller-than-average share of new developments influenced the median price of the transactions, which was one of the lowest of the year, i.e. 1,401 EUR/m2. However, in comparison to the same period last year, the market of Tartu is still more active – in the first nine months of this year, 1,540 transactions were concluded, which is 90 more than last year. Compared to last year, the median price of transactions has increased by 88 EUR/m2, i.e. by 6.5%.

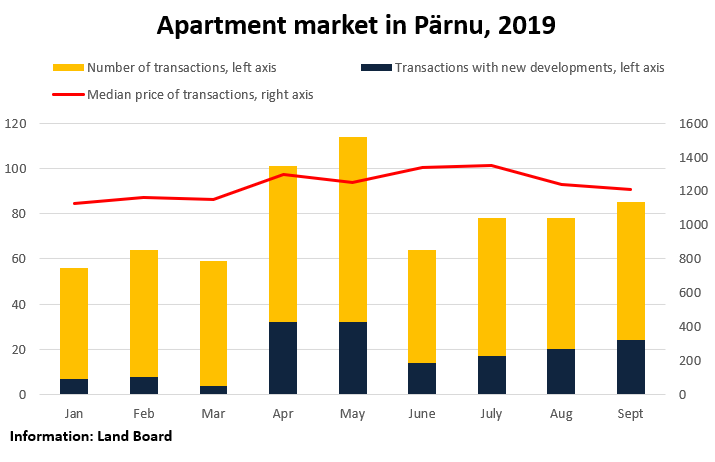

Leaving aside the active spring months characteristic of the summer capital (April and May of this year), September was the most active month this year. In total, 85 transactions were concluded, out of which 24 were concluded with new developments (mostly transactions of Oja Street, Vesiroosi Street, Tiiru Street), which means that also by the number of transactions with new developments September was inferior only to April and May. The activity in the secondary market was at an average stability. This year the average number of transactions in the secondary market has been 60; 61 transactions were concluded in September. Mainly thanks to the increase in the market of new developments, 702 transactions have been concluded in the first nine months of this year, which is 103 more than last year. As the number of transactions with new developments is correlated with the median price of the transactions, the latter has increased this year from 1,178 EUR/m2 to 1,248 EUR/m2, i.e. by nearly 6%.

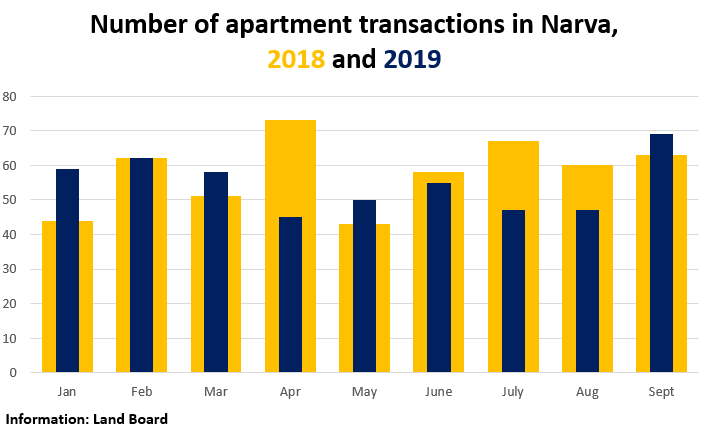

September in Narva was active above average. 69 transactions were concluded but the median price was one of the lowest this year (362 EUR/m2). In comparison to last year, the market has moved on a little. 550 transactions were concluded in the first nine months of the year, which was 21 more than last year. It is good to observe that the decline in price has stopped – based on both last quarter and the first three quarters of this year the median price was 389 EUR/m2. However, in comparison to the three cities above, Narva has not managed to gain much from the real estate boom. In the past five years, the median price of transactions has even dropped – based on the first nine months of year 2014, the median price of transactions was 525 EUR/m2, during the same period of year 2019, however, it was 391 EUR/m2, i.e. 25% less. Considering the 8.8% growth in the consumer prices and the increase in gross monthly salary of over 300 euros in Ida-Viru County, the real estate in Narva is considerably cheaper and more affordable than five years ago. The reasons probably include insecurity about the future, loss of the Russian market and the reduction and aging of the population.

Igor Habal, Uus Maa Real Estate Agency Market Analyst