In October, the people visiting the real estate conference of EKFL admitted that the sentiment of the participants in the real estate market is rather positive and no bigger systematic risks are predicted for the next few years.

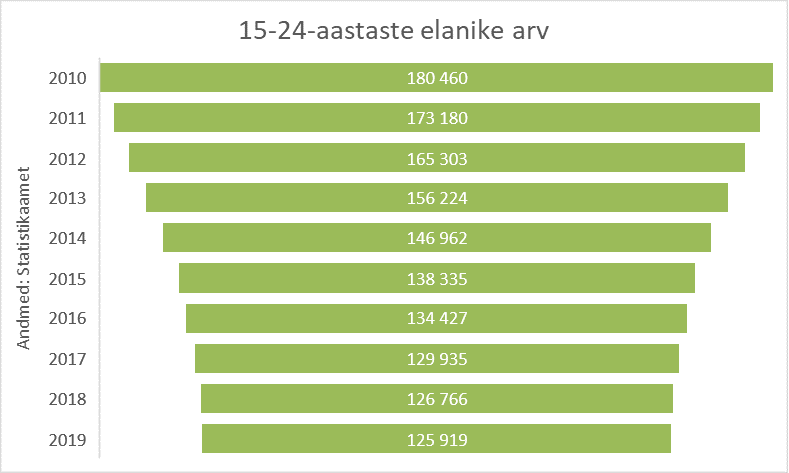

When looking at important indicators more widely, it may be true. However, we know that people are no more competent than chimpanzees at predicting major crises. It is true that people do not speak of a completely cloudless sky; from time to time, the aging and shrinking of our population is mentioned, which could translate to a lower number of transactions in the real estate market in the future. When speaking of demographics, it is good to remember that the number of people who are mainly carrying out real estate transactions these days, i.e. people between 25 and 39, has not significantly changed in the past five years. In 2013, the number of such people in Estonia was 278,914, last year, however, 281,175. As for the next five years, it would be necessary to look at the change in the number of tomorrow’s buyers, i.e. people between 20 and 34. In 2013, there were 277,234 such people, in 2018, however, 254,951 people, i.e. 22,000 people less. In the next 10 years, the situation will become even more negative. Thus, in order to make clever decisions in the real estate market tomorrow, people should consider already the current trends.

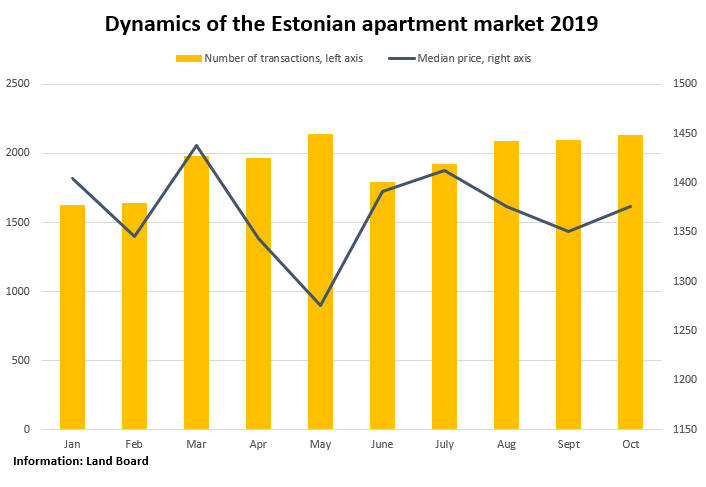

Apartment market in Estonia

Coming back to current events, i.e. the figures of last month, according to initial data, 2,135 sales-purchase transactions were concluded all over Estonia in October. It was one of the best results of the year, only three transactions less than the record-breaking result of May. As always, the market was most influenced by the market of new developments where the largest change came from Võru county, as the first real right transactions of Tamula Homes were reflected in the statistics. That increased the median price of Võru County from the usual level of 350 EUR/m2 to 664 EUR/m2. Even more than Võru County, the median price was influenced by the large share of new developments in Tallinn which was the reason why the number of transactions was so high. The median price of transactions was 1,376 EUR/m2, remaining at the average figure of the year. The median price of transactions was the highest in Harju County (1,852 EUR/m2), followed by Tartu County (1,276 EUR/m2) and Pärnu County (917 EUR/m2). High contrast in Estonia is also demonstrated by the fact that in most of the counties, the median price of transactions remained under 300 EUR/m2.

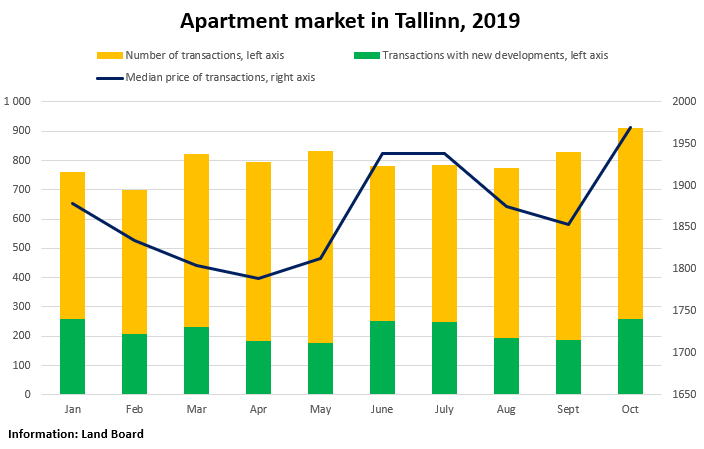

Apartment market in Tallinn, 2019

Already in previous overviews we have mentioned that even though there is no statistical connection between the outdoor temperature and the number of transactions, there is another connection in the market that makes the number of transactions more predictable. That is the connection between the completion term of new developments and the number of transactions. In the recent years, there is an implied rule in Tallinn that people wish to move into a new apartment by Christmas, and thus, the last quarter of the year has become the period where records are broken in the real estate market of Tallinn. However, the trend may change in time, as the Land Board has increasingly started to use the date of the transaction under the law of obligations as the date of transactions with new developments, which creates a more even distribution of transactions in the future.

The best result in regard to the number of transactions was achieved in October with 912 transactions. In comparison to the next best month of this year, the figure of October was better by 80 transactions. The main contribution to the increase came from the largest city districts, most notably Mustamäe, as there are not many months when more transactions are concluded in Mustamäe than in Lasnamäe. But that is what happened in October. This year, the median price of transactions has exceeded the line of 1,900 EUR/m2 already before, but the highest result of all time was achieved in October – 1,969 EUR/m2. Thereby, not only new developments contributed to the price increase, as their share was 28% (nothing extraordinarily high) but also apartments of the secondary market where the price increase is virtually as high as in the new developments. The new developments to prevail in the market were the developments of Kopli Lines, Veerenni district and Sääse Home. As predicted before, the number of transactions shall remain rather stable, unless greater changes take place in the economy; the quicker increase of the asking price of new developments, however, means that soon we will have to get used to overviews where the median price begins with number two.

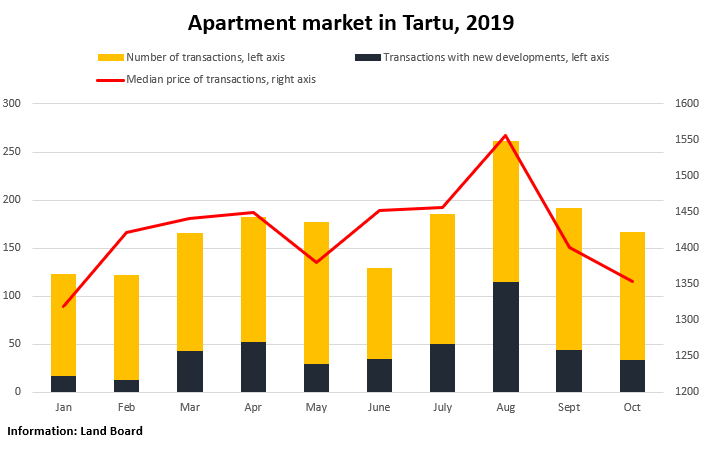

Apartment market in Tartu, 2019

As the depth of new developments in Tartu (i.e. distribution across the year) is lower than in Tallinn, the fluctuation of transactions (called variation in professional language) is bigger across the months. After a very active August and September, the setback in October was quite logical. There was no big rush with real right transactions of new developments, as 34 transactions were concluded for new buildings, the largest number of those at Kristalli Street 12 (7 transactions). Throughout October, 167 transactions were concluded in Tartu, which was 25 less than in September, whereas the average number of transactions per month throughout the year was 170. As the share of new developments was low, also the median price of transactions dropped to 1,353 EUR/m2 in October, i.e. last but one result of the year.

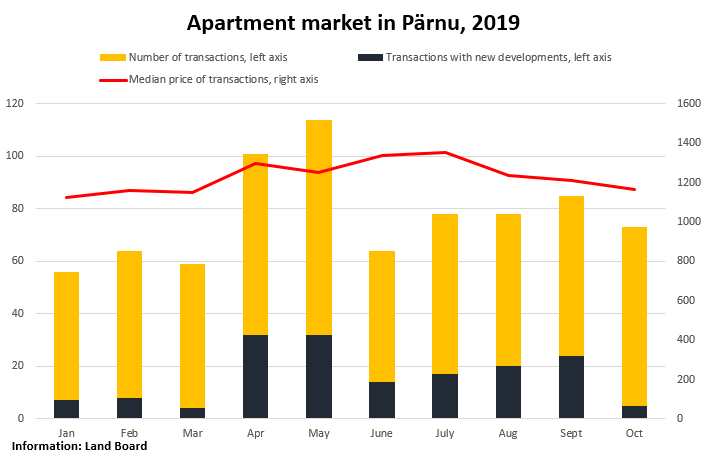

Apartment market in Pärnu, 2019

Similarly to last year, seasonal effects can be observed in the real estate market of Pärnu, which are especially obvious in the situation where the share of the market of new developments is lower in some months. 73 transactions were concluded in Pärnu in October, which highlights the fact that the title of summer capital is history for this year. Compared to the beginning of the year, the market was slightly more active but in the last three months, 78, 78 and 85 transactions have been concluded in Pärnu, and thus we can speak of a decrease by 15–20 transactions. The small volume of new developments is also reflected in the median price of transactions, which was 1,163 EUR/m2 in October, remaining on the low side of the year.

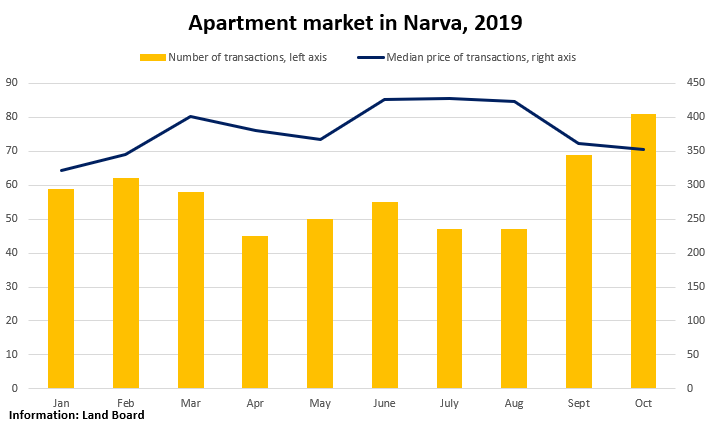

Apartment market in Narva, 2019

October was one of the most active months in the market of Narva, with the number of transactions crossing the line of 80. The median price of transactions, however, moved to the opposite direction – 352 EUR/m2 was the third to last figure of this year. The problems of Narva can actually be extended to all the Ida-Viru County and changes will happen only when large investments are made in the region and the prospects of people will improve. Until then, Ida-Viru County as virtually the only county where real estate transactions have not increased in the past years shall have to face one of the highest unemployment rates in Estonia and a shrinking population.

Igor Habal, Uus Maa Real Estate Agency Market Analyst