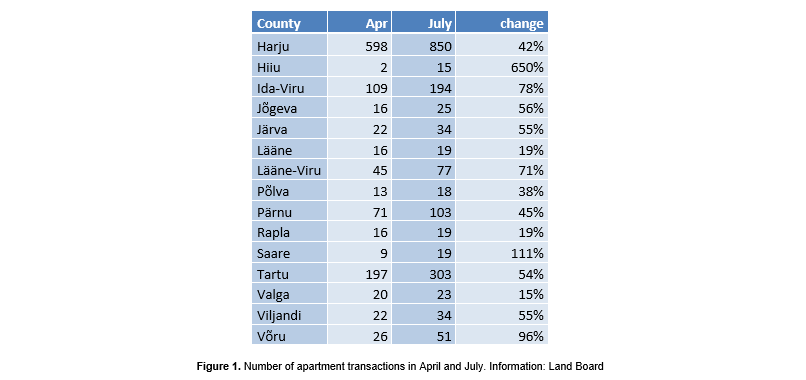

Recovery of the real estate market that started immediately after the restrictions were eased in May and June continued as the next logical step also in July. In July, 1784 apartment transactions were concluded in all Estonia, which was 290 (i.e. nearly one fifth) more than in June. There is still some distance to cover till the pre-pandemic results (–10% in comparison to 12 months prior to the crisis), but more and more promising results all over Estonia show that people have recovered from the first shock. Next to the number of transactions, during the first seven months the median price has increased by 6% in the comparison of years, which means that the financial volume of the apartment market has dropped only by 7%.

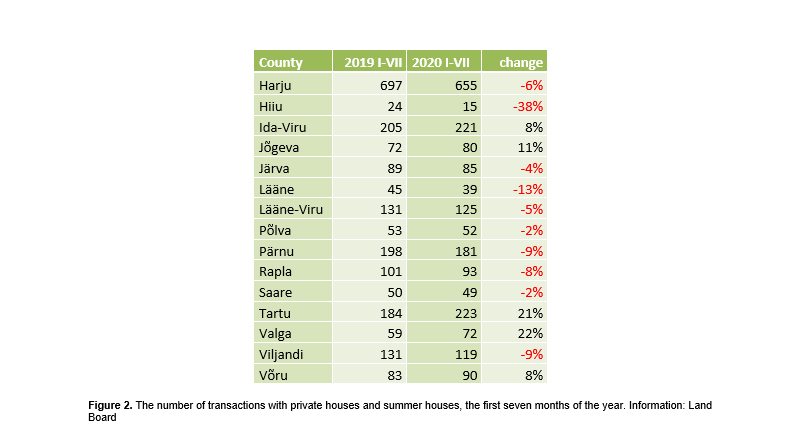

If we must speak of a decline of the apartment market in regard to this year, the market of houses and summer houses has already recovered from the first shock, which is also reflected in the statistical figures: in comparison to the same period last year, only 23 transactions less have been concluded (a mere 1.1%), whereas outside Harju County 44 transactions more were carried out with summer houses. The statistics is also confirmed by the observations of real estate agents that cheaper plots of land and summer houses are most actively sought today. The number of transactions might have been even higher in July but various parties have stated that the loan mills of banks operate more thoroughly and also slower.

Thus, it is still too soon to speak of a statistical price drop for most types of real estate. There are desirable objects for which the prices have not been lowered; however, flexibility of the seller speeds up the sale and it is also true that with high offering and decreased demand the price of typical older real estate in poorer condition has been affected first.

The price drop has also stopped in the lease market and during the high season also well-furnished lease apartments at good locations are attractive enough, occasionally even for the prices of last year. With the recovery of the lease market, the interest of buyers in investment apartments has also resurfaced.

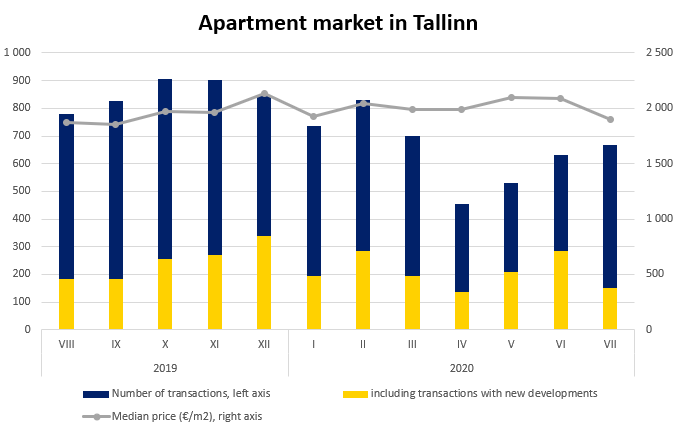

In the first post-crisis months, the increase in the number of transactions was mainly driven by the realisation of previously agreed transactions with new developments. In May, for instance, the share of new developments was 39% and in June even 45%, whereas in comparison to April, the number of transactions on the secondary market in June had increased by less than 30. In Tartu, both in May and June the number of transactions with new developments was 39%, and similarly to Tallinn, the increase of the secondary market was small. A similar tendency could also be observed in Pärnu where the share of new developments in May was 29%. However, in June the gravity centre shifted and the activity of the secondary market increased considerably. In the seventh month of the year, 667 sales-purchase transactions were concluded in Tallinn, of which 517 were concluded on the secondary market, i.e. 200 more than in April. Due to the large share of the secondary market, after the two months with active transactions with new developments the median price fell below 2000 €/m2, dropping to the level of last year. In comparison to last July, the number of transactions concluded was lower by nearly one fifth.

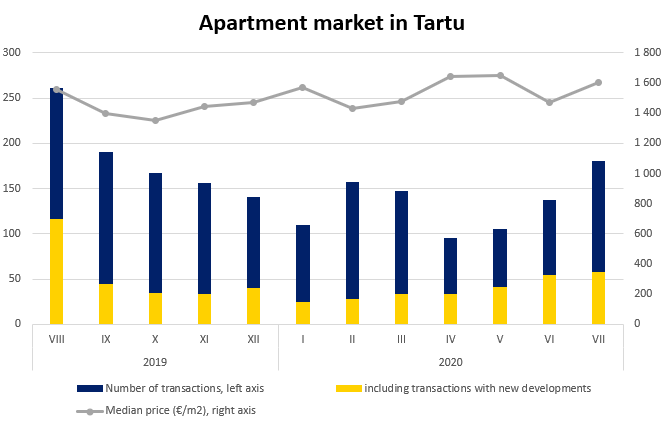

Unlike in Tallinn, in Tartu July was an active month also for new developments (54 transactions in June, 58 transactions in July). However, a large increase in the number of transactions came mainly from the secondary market where 123 transactions were concluded, which by volume reflected the pre-crisis level. This year, the median price of transactions in Tartu was over 1,600 €/m2 for the third time (1,607 €/m2). In comparison to last year, the median price of transactions increased by 9.4%, the number of transactions was lower by 20.

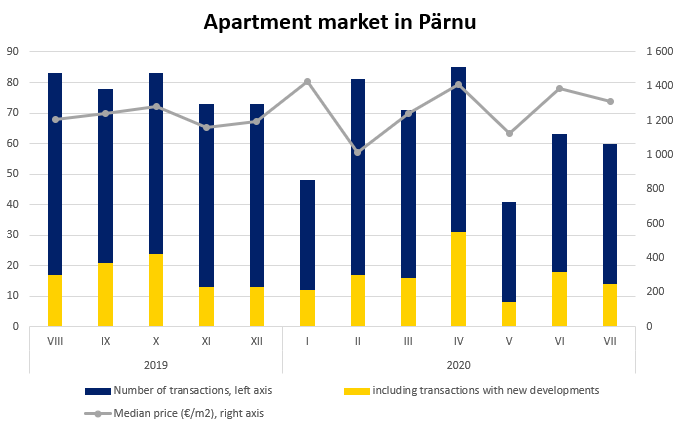

In Pärnu, 68 transactions were concluded in July. In comparison to June, 8 transactions more were concluded and in comparison to April, 27 transactions more. Similarly to Tallinn and Tartu, the number of transactions was most of all influenced by the secondary market where 57 transactions were concluded, which also remains at the pre-crisis level. Due to the high share of the secondary market, the median price was lower than in May and June (1,241 €/m2), but nearly 3% higher than during the same period last year.

In July, 49 transactions were concluded in Narva, which was the largest number since April. The post-Coronavirus bottom was hit in May with 38 transactions, but also 49 transactions show that the market is still at a low level, as in the pre-crisis period, the number of transactions per month was over 60 as a rule. The median price of transactions was the lowest this year, 347 €/m2. A year ago the median price of transactions was 462 €/m2.