In the real estate market, August continued to carry the spirit of July – the epidemic of coronavirus started to fade from the minds of people or they simply stopped paying much attention to it.

Transaction activity increased and the people who were waiting for a larger price drop went through a disappointing month. However, the dream of quick recovery of the optimists must be cooled: the coronavirus epidemic with new, if not so strict restrictions will rise again. Many companies that applied for continued salary compensation have received a green light for dismissal of employees; also the situation of our main trade partners is insecure and consumer confidence has not reached the pre-crisis level. In Tallinn and Tartu, recovery has been mainly upheld by transactions with new developments of which the majority had been concluded before the beginning of the emergency situation; statistically, the decrease in volumes will reach the market of new developments within the next six months, which in a broader perspective means a drop in the number of transactions.

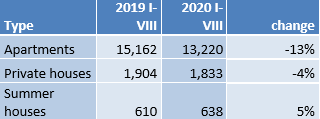

1,832 transactions were concluded in Tallinn in August, i.e. 45 transactions more than in July. In comparison to one year ago, the number of transactions dropped by nearly 12%; in the first eight months of the year, the number of transactions has dropped by 12.5%. Based on the first eight months, the number of transactions in most counties has dropped by 10 to 15%; the number of transactions has increased in Võru, Põlva and Lääne counties. The increase in the number of transactions of over one third in Võru County has been pulled by the development of Tamula Homes. In comparison to one year ago, the median price of transactions has increased by 5%, in August the median price was at the lowest point of this year (1,322 €/m2), where the first signs of a price correction are already visible. In the first eight months, the median price increased by 8.2% in Harju County (1,897 €/m2) and by 9.7% (1514 €/m2) in Tartu County; the prices have dropped only in four counties, which is mainly due to the structure of transactions.

The market of houses and summer houses is still active; if in the growth phase of the market the more liquid apartment market showed quicker growth figures, in the decline phase the less liquid market of houses has managed to keep the volume of transactions; in the market of summer houses the number of transactions has even increased. Based on the example of Harju County it may still be admitted that, for instance, for summer houses the growth has not been similar everywhere. When purchasing a summer house, people prefer locations by and near the sea (Harku Municipality, Lääne-Harju Municipality); inland summer houses have created much less interest.

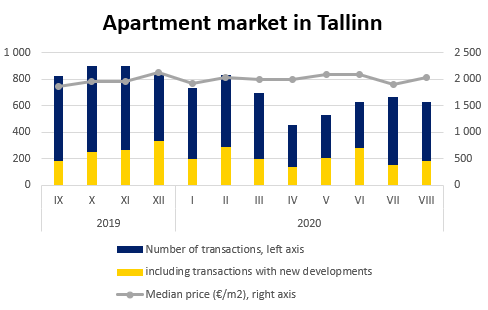

Apartment market in Tallinn

Even though the figures of July remained out of reach due to the drop in the secondary market, over 600 transactions were concluded in Tallinn for the third consecutive month.

Even though in comparison to July more transactions were concluded with new apartments, the 15% drop in the secondary market brought the transactions of August back to the level of June. In comparison to July and August of last year, the volume of the secondary market has decreased by 20% (6% in new developments); in the first eight months of the year, the number of transactions has dropped by 18%, i.e. slightly more than in Pärnu or Tartu.

Due to a higher volume of new developments, the median price climbed past 2,000 €/m2 again; in the comparison of years, the median price has increased by 8%. Speaking of price movements, the year has been rather volatile: in April and May, the prices dropped by up to 5% in comparison to the beginning of the year; today, the top prices have not yet been restored but the prices have started to move upwards bit by bit. As for new developments, apartments are more frequently sold with kitchen furniture included, which statistically does not qualify as a discount.

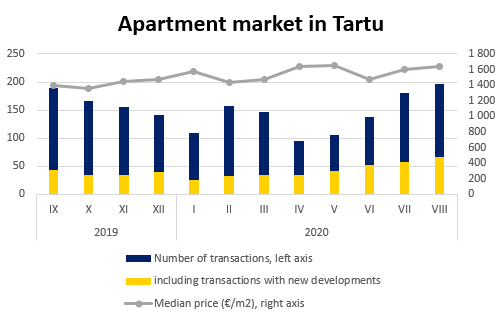

Apartment market in Tartu

In Tartu, August was the most active month of the year, as 197 apartment transactions were concluded, which was 16 more than in July.

Again, the number of transactions was upheld by the 35% share of new developments but the figures of the secondary market in the past two months give signs of recovery of the secondary market: in comparison to April, May and June, nearly twice as many transactions were concluded in July and August.

The secondary market has not reached the pre-crisis level just yet; in comparison to the July and August of last year, the number of transactions in the secondary market was 15% lower. In the comparison of years, the number of transactions has dropped by 17% in the first eight months, which is mainly from the secondary market, as only 9 transactions less than last year have been concluded with new developments.

It means that if last year the share of new developments was 25.7% in the first eight months, this year it has been over 30%. Such a structural change has meant several record-breaking months from the perspective of prices (in August, the median price was over 1,600 €/m2 again); within a year, the median price of transactions has increased by 8%. In new developments, the median price has increased by 15% in one year, to nearly 2,000 €/m2, the price increase in the secondary market has remained at 4% (7% in Annelinn).

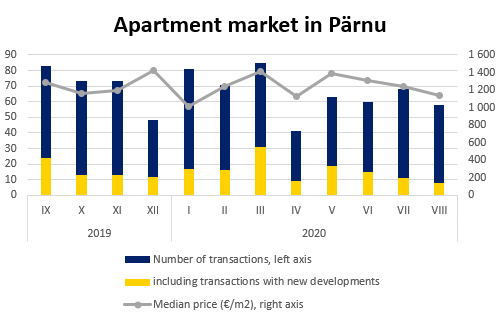

Apartment market in Pärnu

58 transactions were concluded in Pärnu, remaining at the activity level of the previous months. In comparison to one year ago, 20 transactions less were concluded; in the first eight months of the year, the number of transactions has dropped 15% in comparison to last year.

The cause is a general drop in the number of transactions, which has spared neither the market of new developments nor the secondary market. The figures of the secondary market in July and August give signs of nearly full recovery of the secondary market.

The median price of transactions remains at the level of last year; the median price of the first eight months of this year, as well as the first eight months of last year, was 1,247 €/m2, which for a similar volume of new developments (22 to 23%) refers to a stop in the price increase. In August, the median price was 1,137 €/m2, which was lower than last year by over 100 €/m2.

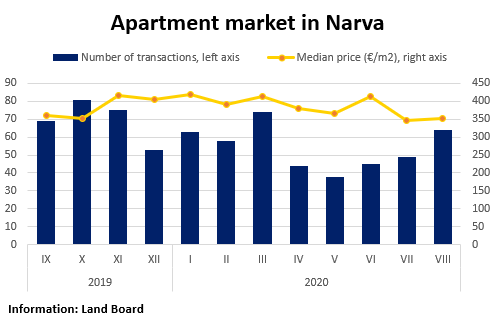

Apartment market in Narva

64 transactions were concluded in Narva, which was the highest number since April and the second-best result of the year after March. In comparison to last August, 13 transactions more were concluded.

In the first eight months of the year, the number of transactions has dropped by 10% in comparison to the same period last year. The median price of transactions reflects reduced demand due to the emergency situation; the median price of transactions in August was 352 €/m2, dropping by 15% in comparison to last year. In the first eight months of the year, the median price has increased only by 1%, remaining at 393 €/m2.

The fact is confirmed by the yearly price comparison in standard buildings: the median price of 2-room apartments is still between 17,000 and 18,000 euros; the price of 3-room apartments is between 32,000 to 33,000 euros.