Regardless of holiday waves and the warm August, the real estate market was operating at top speed.

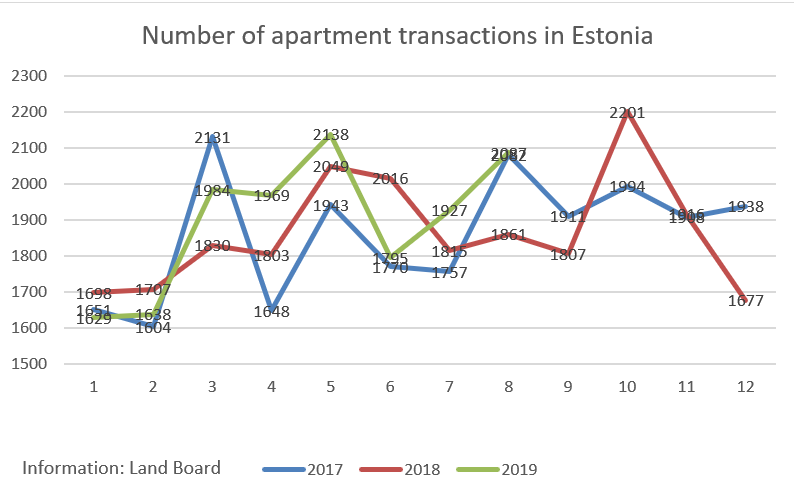

According to the final figures, 2,087 sales-purchase transactions of apartment ownerships were concluded in August, which was the second best result of this year. 15,173 transactions were concluded in the first eight months of this year, which was 393 more than last year. In August, the median price of transactions was lower than in June or July (1,376 EUR/m2), which was mainly based on the smaller share of Tallinn. In August, the share of Tallinn in the transactions was 37.1%, this year it has mainly remained between 40% and 42%. During the first eight months, the median price of transactions has increased by 3.2% in comparison to the same period last year, reaching 1,370 EUR/m2.

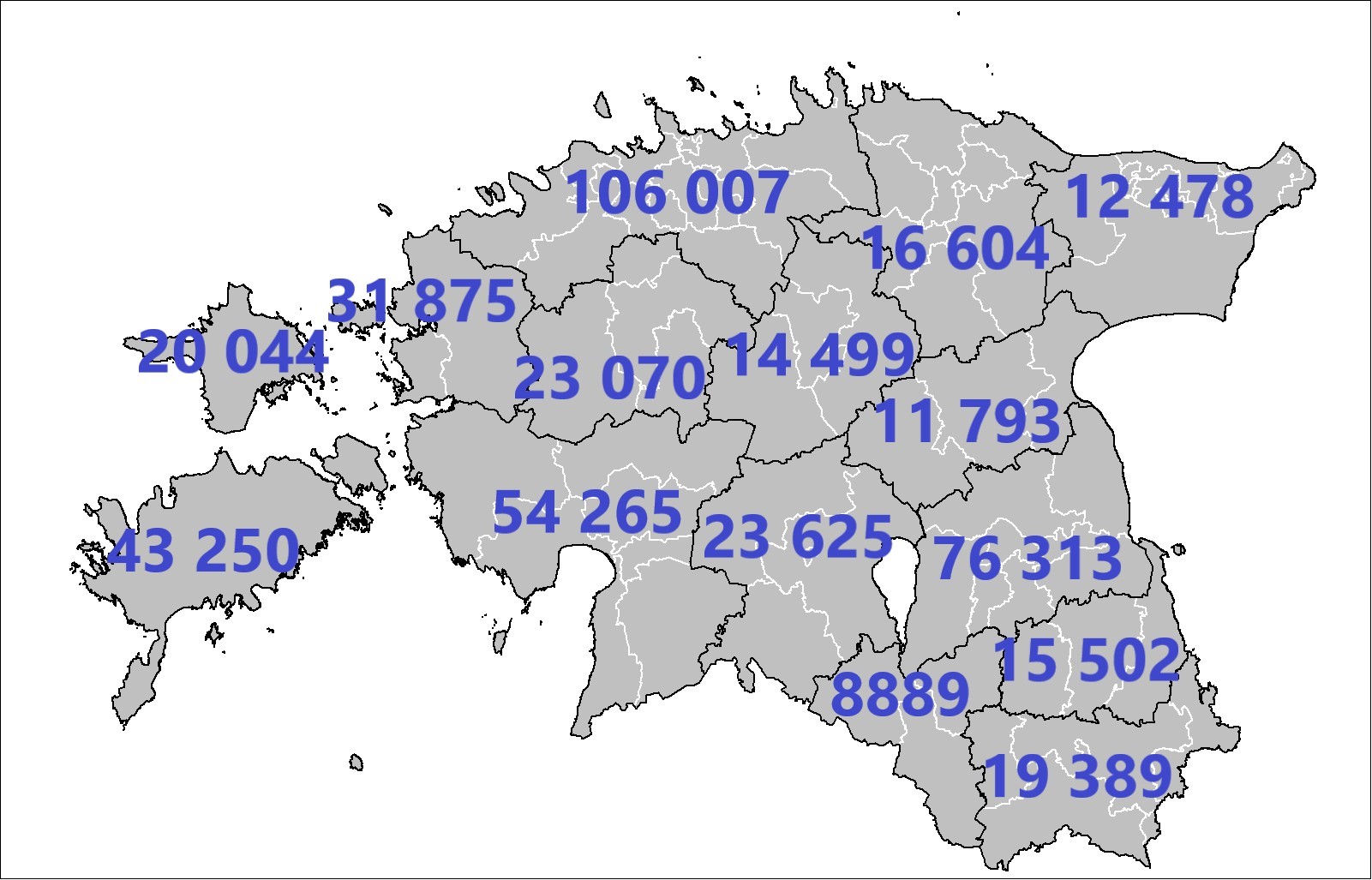

During the first eight months of this year, most of the counties have seen an increase in the number of transactions and the median price in comparison to the same period last year. As a rule, the largest growth has taken place in the counties where the transactions are influenced by the market of new developments. In Harju County, the number of transactions increased by 74, in Pärnu County by 85 and in Tartu County by 96 in comparison to the same period last year. Strong growth was also shown by Ida-Viru County where the number of transactions increased by 95 in comparison to the first eight months of last year, which was mainly caused by the active April and May, as in general, the market in Ida-Viru County is a stable one. However, the biggest increase in the number of transactions took place in Harju County outside Tallinn (+183 in comparison to the first eight months of last year), which on the one hand points at the reduced number of new developments in Tallinn and on the other hand at the increase of development volumes outside Tallinn where in spite of the increase in input prices it is still possible to obtain a good margin, so that the final price of an average apartment is still cheaper than in Tallinn. During the past year, the geography of new developments in Harju County has expanded, new apartments in Anija and Kose municipalities are available.

Based on the first eight months, the median price in Estonia was 1,370 EUR/m2, which was about 3% higher than last year. Unlike the number of transactions, the price increase was extensive. The only areas where the median price dropped were Ida-Viru County and Võru County, the rest of the counties showed a good price increase. The price increase was the biggest in Harju County (+86 EUR/m2 in comparison to last year), Hiiumaa (+100 EUR/m2) and Lääne County (+122 EUR/m2). In the two last counties, there is no influence of new developments. However, the share of more valued districts has increased since last year.

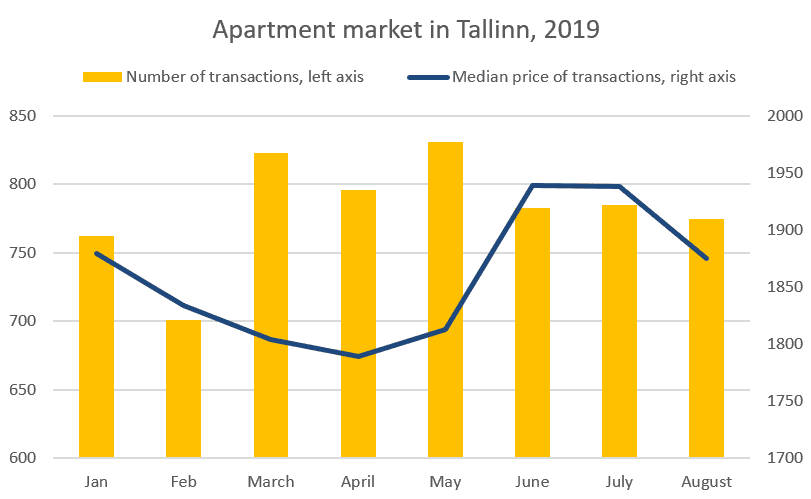

As was said before, in the first eight months of the year, the number of transactions in Tallinn has dropped by over 100 in comparison to the same period last year (6,408→6,299), whereas the median price of transactions has increased by 6.5% (1,858 EUR/m2). The peak activity in the number of transactions in Tallinn remained at the end of year 2017 and the beginning of year 2018. After that period, the quick increase in the input prices and the reduced profitability of equity have become more and more topical; also, the offering of new developments has slowed down and the number of residential premises with building permits has dropped.

We have probably already moved into a more stable phase where it is difficult to expect a larger growth, whereas the price increase has not slowed down considerably due to reduced competition. However, the sustainability of the market in Tallinn is strong because regardless of the reduced and aging population in the counties, the number of the main real estate buyers in the capital is still quite large. Five years ago, the number of inhabitants in Tallinn aged 20 to 24 was 27,561, in 2019, however, 29,683. Thus, unless the economic situation and trends change dramatically, the demand of the next 10 years should not significantly change either

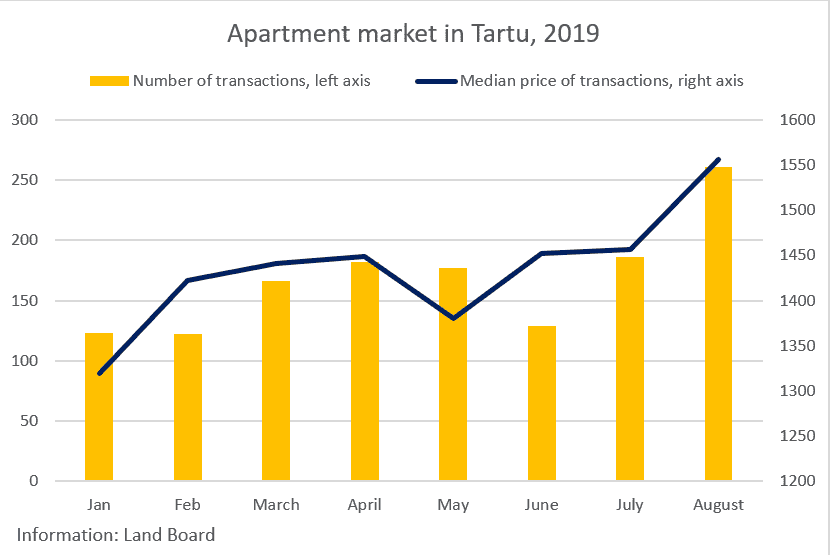

As to the market of Tartu, we have said before that in comparison to Tallinn, both the security of developers and the statistics of building permits are more positive. In August, there were transactions of several larger developments (Kristalli, Kummeli, Riia Quarter), and thus even 261 transactions were concluded, which was also the best result of the past years. In the second-best month of the year, July, 186 transactions were concluded (i.e. 75 less). As the market share of new developments was larger than normally, also the median price of apartment transactions was very high – 1,556 EUR/m2, i.e. by 100 EUR/m2 higher than in July. In the first eight months of the year, the market of Tartu has taken a step forward compared to last year: the number of apartment transactions increased by 52 (1,358→1,458), the median price of transactions, however, by 100 EUR/m2 i.e. by 7.4%.

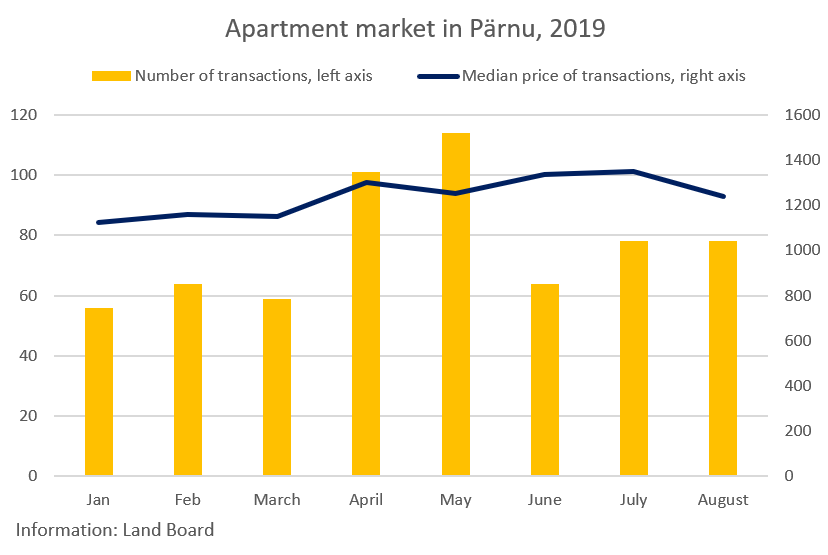

In Pärnu and Narva little by little

In Pärnu, August was rather ordinary compared to the rest of the year: 78 apartment transactions were concluded with a median price of 1,239 EUR/m2. The most active months of the year were April and May with over 100 transactions. Those months were influenced by the developments in Oja and Ringi Streets, which formed nearly one fourth of the total number of transactions. In the first eight months of the year, due to an increase in the volume of new developments, the number of transactions has increased by 84 in comparison to last year (539→623), and the median price has increased by 4.6% (1,193→1,248 EUR/m2).

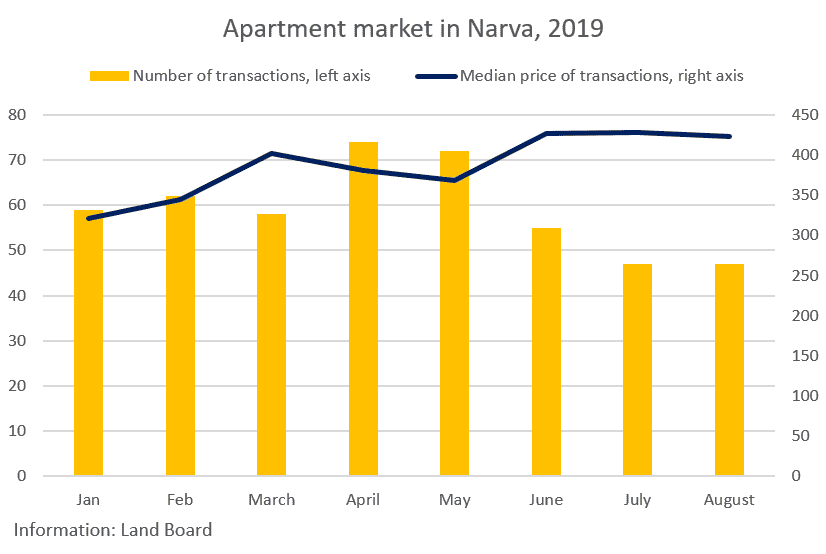

In Narva, August was one of the quietest months of the year. Similarly to July, 47 transactions were concluded, which was the smallest figure after May 2018. However, the median price of transactions was over 400 EUR/m2 for the third consecutive month, and according to KV.EE, the asking price has not dropped either. In comparison to the same period last year, the number of transactions in Narva is slightly positive (+12 transactions), also the median price of transactions has remained stable (391 EUR/m2 in the first eight months of the year), which in the environment of quick inflation of this year means that the real estate price has still dropped and there is a backlog compared to the general development of the real estate market.