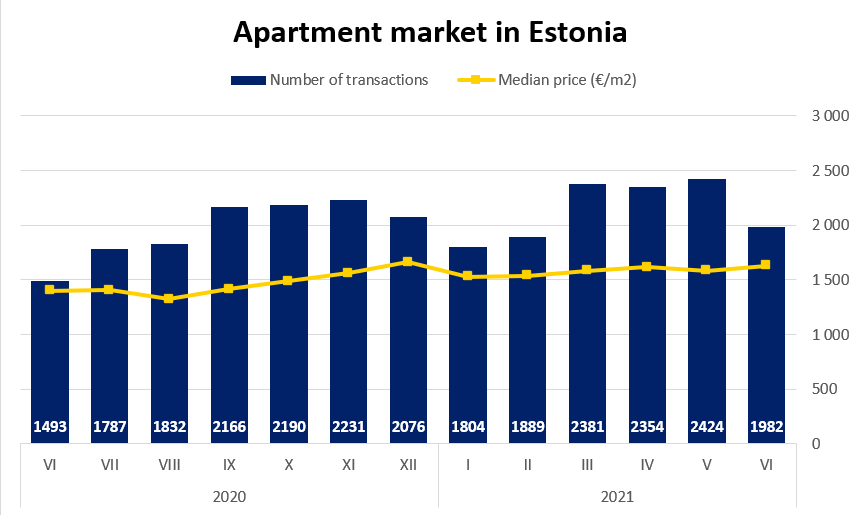

In comparison to the previous three months with 2,300+ apartment ownership transactions, June with its heat wave, holidays and lifted restrictions was already less active. The number of transactions ultimately ended at 1,982 – in the short perspective this was a drop but in the long perspective the market still continues at the top of the wave of high activity. There are still some people in the market who failed to make their purchase decisions last year, even though it would be clearly too much to attribute the growth in activity just to that group.

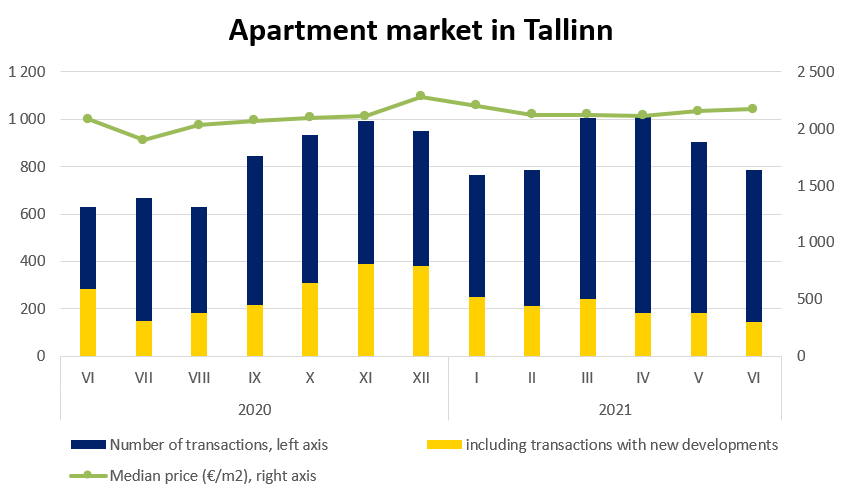

The market of new developments in Tallinn continues its rush, regardless of the fact that more than 1,000 new apartments became available during the 2nd quarter – stock absorption is currently around six months, which means that the pace is twice as fast as in normal situation. And as many of the current transactions with new developments, which statistically are completed with a delay, are often the mirror of the market, due to high activity in the situation of money-printing and low interest rate we do not see any potential for a price drop.

Estonia

With 1,982 transactions, the median price of the apartments sold in all of Estonia during June was again over 1,600 €/m2 (specifically 1,630 €/m2), and it was only slightly less than the record-breaking result of last December.

As for the counties, only Jõgeva County and Lääne County have shown less than 10% growth in the number of apartment transactions. In Harju County, for instance, the growth in six months was 32.6%, In Ida-Viru County it was 30.4% and in Tartu County it was even 51.9%.

In comparison to last year, the median price of transactions only dropped in Hiiu and Rapla counties, which is more about the statistic peculiarities of small markets than an actual drop. Based on the data of the first six months of the year, the median price in Harju County was 2,004 €/m2 (+4.6%), followed by Tartu County (1,655 €/m2, +12.8%) and Pärnu County (1,131 €/m2, +7.4%).

Apartment market in Tallinn

The high pace of the new developments in Tallinn was already mentioned – 142 apartments had real right transactions in June. It was the lowest number of this year, which (as always for transactions with new developments) mainly depends on the transfer of apartments to the buyers, not the sales under the law of obligations. If we add also the secondary market transactions (645 in June), the number of transactions concluded in June was 787. A quick look at the division says that the main drop in the number of transactions came from new developments, as the figures of the secondary market are still delightfully high. The result was still somewhat better than those of January and February, as well as last June.

n comparison to the first six months of last year, the number of transactions has increased by 35.8% this year, regardless of the drop in the number of transactions with new developments by about 250. The median price of transactions in Tallinn was 2,173 €/m2, and in comparison to the first six months of last year, this year the median price has increased by 6.9%.

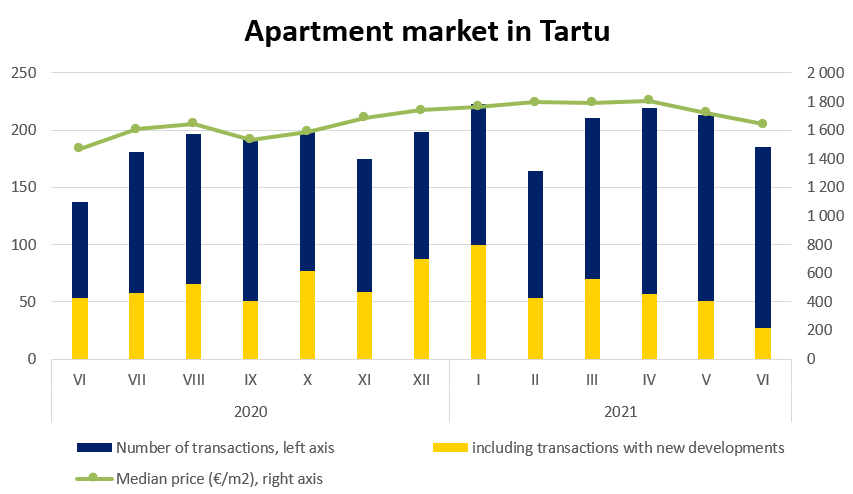

Apartment market in Tartu

In comparison to last year, the activity of the market has increased at the fastest pace in Tartu, and mainly due to new developments, as the growth pace of the secondary market in Tartu is the same as in the capital. 185 transactions were concluded in June, which only beat the result of this February, but when we look at it across the years, the result is well above average. The market of new developments brought a slight decline to the month of June (27 transactions) whereas the high pace of the secondary market has persisted. The small share of new developments was also reflected in the median price of transactions which was the lowest of the year (1,642 €/m2). In comparison to the first six months of last year, the number of transactions in Tartu has increased by 61.8% and the median price by 16.9%.

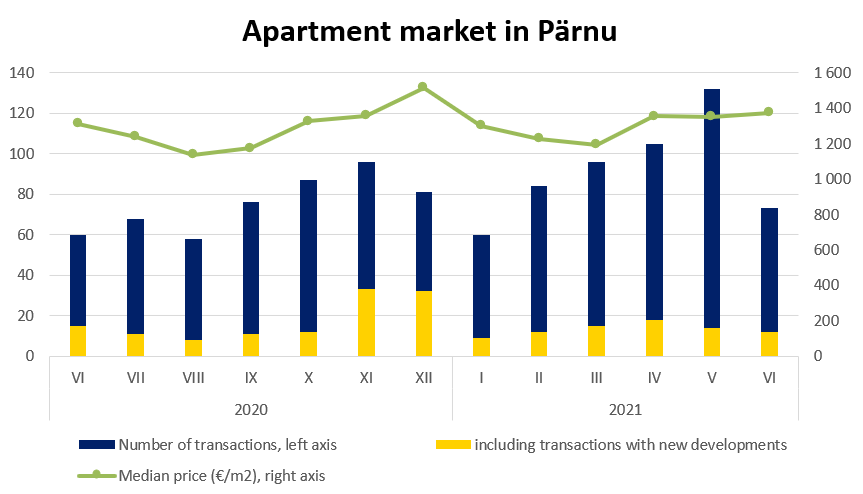

Apartment market in Pärnu

In Pärnu, the market returned to normalcy in June – in total, 73 transactions were concluded, of which 12 in new developments and 61 in the secondary market. The figures of the secondary market are slightly higher than usual, whereas the result remained at the level of the first months of the year, just like on other cities.

For the third month, the median price of transactions was over 1,300 €/m2, based on the first six months the number of transactions has increased by 37.4% in comparison to the same period last year, the median price, however, only 1.5%. The small increase in the median price is based on the lower share of new developments, the actual price increase is still higher.

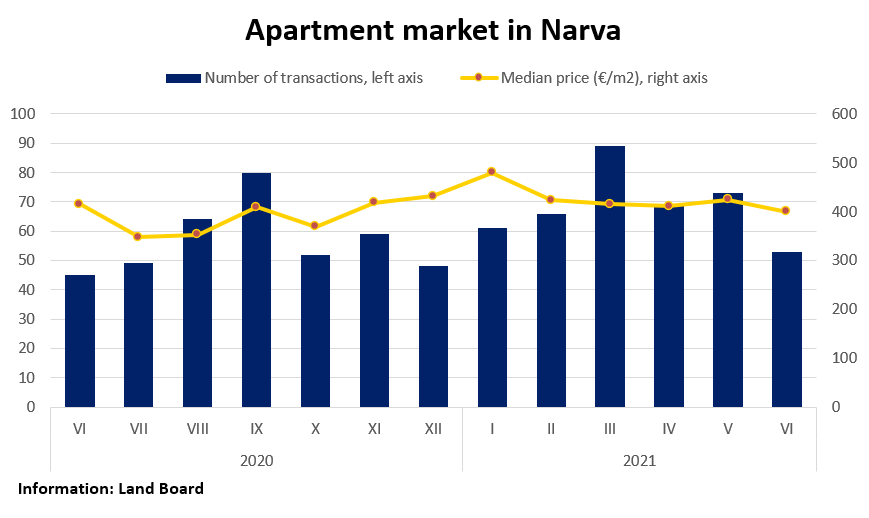

Apartment market in Narva

53 transactions were concluded in Narva in June, it was the lowest result of the year and it was also below the long-term average. The drop may not be caused by lower activity, the bigger culprit is probably the drop in the number of offers.

The median price of transactions was also in slight decline (400 €/m2) but unlike in previous years, this year it has not dropped below the level of 400 €/m2 even once. Across the first six months, the number of transactions in the border city has increased by 28%, the median price of transactions by 4.8%.

Houses and cottages

If the number of apartment transactions has increased by one third in comparison to the first six months of last year, the increase in the market of houses and summer houses has been 43%. 460 transactions were concluded in June, which was still a little less than the results of April and May. The larger growth in numbers have naturally been seen in larger counties, for instance in Harju County over 250 transactions more were concluded, in Tartu County 77 transactions more, in Ida-Viru, Lääne-Viru and Pärnu County there were 60+ transactions more.

Higher activity has had a positive impact also on the prices of houses – for instance in Harju County the average price of transactions was over 260,000 euros (last year it was 224,000 euros) and in Pärnu County it was 110,000 euros (last year a little less than 90,000 euros), whereas the level of Tartu County (145,000 euros) is similar to that of last year.