Based on the transactions of March and April we can say that the period has been very active and looks like a boom. Regardless of the near-deficit of offering, we have not seen such activity since year 2007.

The low offering has shortened the sales periods, we increasingly hear of overbidding, and as for new developments, there is again a situation where the apartments of quite a few developments have been already booked before or in the initial stage of public sale; apartments are already being sold in buildings that will be completed only in 2023.

The strong demand has been supported by stable financing terms, lower-than-usual consumption expenses and an increased desire to acquire property against the risk of inflation. The activity has even further increased in the situation where last years developers slowed down building and many people failed to make purchase decisions due to the insecure situation.

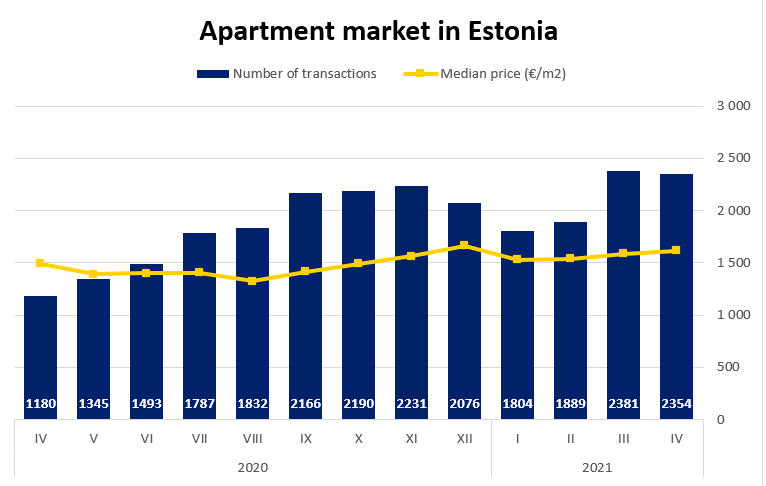

Estonia

Similarly to March, over 2,000 apartment transactions were concluded in April. If the number of transactions in March was 2,381, in April 2,354 apartment ownerships were bought and sold. The last time when we saw over 2,300 transactions was in May 2007 (2,411 transactions), whereas when we look at the months of April, it was the most active April of all time. The median price of transactions was 1,614 €/m2, losing only to last December. In comparison to the exceptional last year, in the first four months of this year over 25% more transactions have been concluded, whereas the difference with the same period in 2019 is +16.9%. The median price of transactions has increased by 5.5% in the same period, reaching 1,563 €/m2.

The activity has not been limited to just the apartment market; 482 transactions were concluded with houses and summer houses, which was 82 more than in March. Last year, the threshold of 400 transactions was only crossed in June, July and September. The offering in the market of houses and summer houses is also lower than average. As for summer houses, the 47 transactions in Ida-Viru County are worth mentioning, in average, over 20 transactions less have been concluded in April so far. The market of summer houses and houses is currently definitely hotter than it was between 2005 and 2007. This year there have been five months with over 400 transactions within 12 months, back then there were also five months with over 400 transactions but over a longer period. 483 transactions were concluded with plots of residential land, which was less than the 572 transactions in March, but it is worth mentioning that last year there were no months with even 400 transactions.

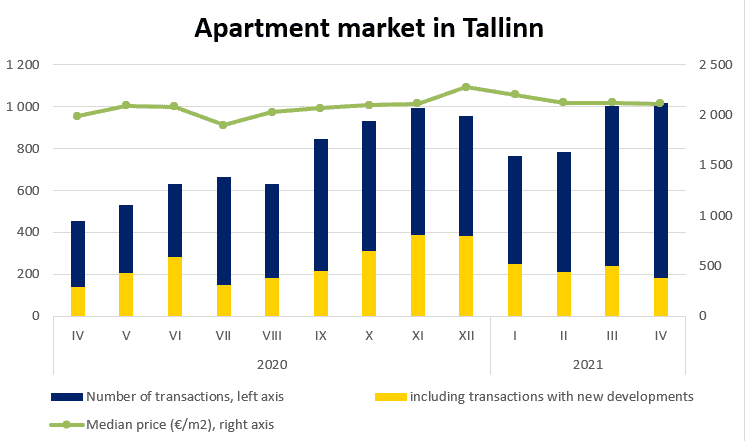

Apartment market in Tallinn

In Tallinn, the mirror of the Estonian real estate market, over 1000 transactions were concluded for the second consecutive month. If 1004 transactions were concluded in March, the number in April was already 1020. Last time such a result was achieved in year 2007, which is a rather good indicator of the current high activity in the market. Such a result was achieved even though the public offering is still low and the share of new developments in April was below 20%. Activity was pushed up by the secondary market – if previously a good month was one with over 600 transactions, in March there were even 763 transactions and in April the figure was even 839. The share of new developments will probably remain lower this year, but as we can see, it is well balanced by an enthusiastic secondary market.

For the sixth consecutive month, the median price of transactions was over 2,100 €/m2, the median price in April reached 2,113 €/m2. Based on the first four months of the year, the median price of transactions was 2,138 €/m2, i.e. 7.4% higher than last year. The median price of transactions with new developments was 2,813 €/m2 (+9.2%) and on the secondary market 1,907 €/m2 (+6.2%).

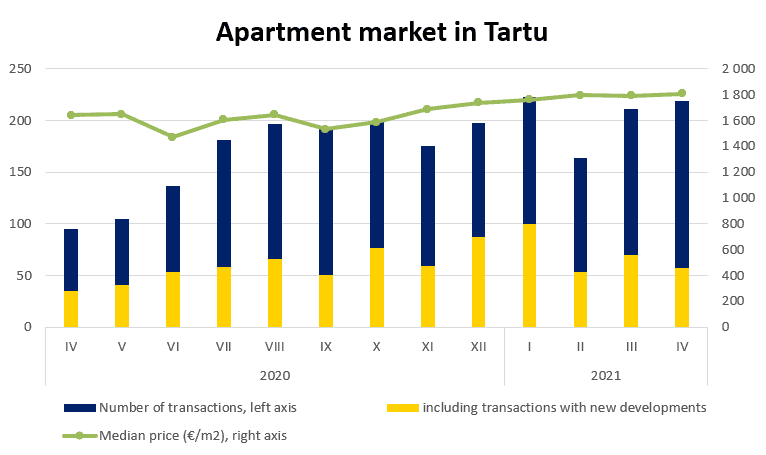

Apartment market in Tartu

In Tartu, over 200 transactions were concluded for the second consecutive quarter and for the third month this year. Last time the number of transactions exceeded 200 in 2019, but then the figure was only exceeded in two months. Out of the 219 transactions, 57 were concluded with new developments, i.e. slightly less than the average of last year. However, in the secondary market, the best result after year 2007 was reached, i.e. 162 transactions. 819 transactions were concluded in the first four months of the year. If we put aside year 2020, which was out of the ordinary, then for instance in 2019 less than 600 transactions had been concluded by that time.

Regardless of the slightly lower share of new developments, the median price of transactions was the highest of all time, exceeding the threshold of 1,800 €/m2 for the first time. The near-deficit volume of offering has also quickly increased the price level of apartments in the secondary market. The median price of transactions for the first four months of the year was 1,784 €/m2 (+19.3% in comparison to the same period last year), the median price of transactions with new developments was 2,258 €/m2 (+15.3%), for the secondary market it was 1,530 €/m2 (+11.1%).

Apartment market in Pärnu

In Pärnu, over 100 transactions were concluded in April – that is a very large figure in the context of Pärnu. For instance, last year such a figure was never reached and in in 2019 it was only achieved twice. Out of 105 transactions, 18 were concluded with new developments. Thus, the high activity was based on the secondary market where even 87 transactions were concluded. 345 sales-purchase transactions have already been concluded in the first four months of the year, whereas in past years the figure has remained below 300. It is remarkable that only 54 transactions with new developments were concluded in the first four months (last year the figure was 73), and thus the price increase within one year was just 3.8%. In April, the median price of transactions was 1,354 €/m2, the figure for the first four months was 1,281 €/m2.

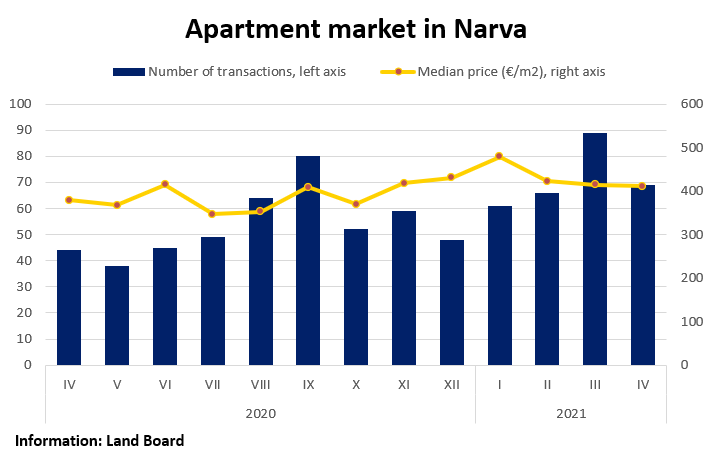

Apartment market in Narva

In Narva, 69 transactions were concluded in April, which was once again an active month above average. In average, a little less than 60 transactions per month have been concluded in Narva, the average of the first four months of this year, however, is 71. The increased number of transactions has caused a price increase – if the median price of the first four months of last year was 406 €/m2, this year the median price was 5.7% higher, i.e. 429 €/m2. In April, the median price was the lowest of this year (411 €/m2), but in comparison to the same period last year, it increased by 50 €/m2.