The overview of real estate market in March cannot escape the topic of coronavirus COVID-19 outbreak which started to influence the market considerably from the second half of the month.

Estonian Real Estate Market in March 2020

As the majority of transactions had already been agreed, no big decline in the number of transactions can yet be observed in March; so far, more liquid assets like lease property have reacted faster to the changes, the drop in the sales price will reach the statistics in up to six months.

The movement of short-term lease offering to the long-term lease market has increased the long-term lease offering by about one fourth, price gaps have emerged between transaction and asking prices, active price negotiations are taking place in the existing lease relationships, which mostly means a temporary price drop of 20 to 30%.

In the sales market we see clearly lower activity, which has had a bigger influence on more expensive and less liquid real estate but if the crisis continues for a longer period, an extensive decline can be expected. We will probably see a drop in the number of transactions by 50% in the next few months and a 10% price drop over the next six months but possibly even more.

However, predictions about the behaviour of the real estate market are difficult to make as everything greatly depends on how long the corona epidemic and the consequent emergency situation will last and how thoroughly it will shake the economy.

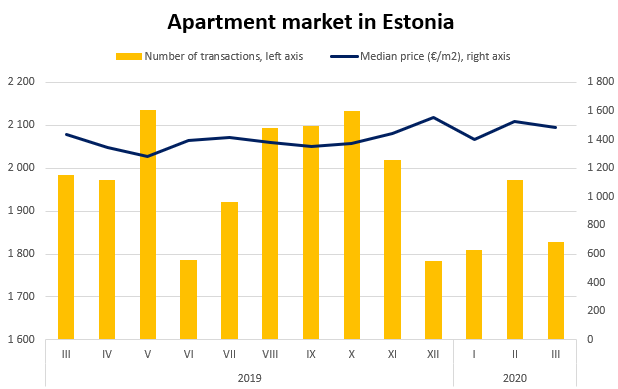

In March, 1,827 transactions were concluded with apartment ownerships, which in comparison to the average of the previous 12 months was 150 transactions less, i.e. in March we can see a drop in the number of transactions by 7.5%. In comparison to the average of the previous 12 months the decline was rather extensive – the number of transactions did not drop only in four counties.

The largest drop could be observed in Harju County where 990 transactions were concluded, i.e. 167 transactions less than the average of last year. In the other counties, in comparison to the average, the number of transactions dropped by 12, over 20 transactions less were concluded also in Tartu and Lääne-Viru counties.

As the price drop in the markets where the share of new developments is greater takes place with a delay, the median price figures in March were still close to the record. In Estonia as a whole the median price of transactions was over 1,400 €/m2 for the fifth consecutive month; in comparison to the previous 12 months the median price increased by 5.8%.

The highest median price of transactions could be observed in Harju County where it was nearly 1,900 €/m2, the median price was over 1,000 €/m2 also in Tartu County (1,386 €/m2) and Pärnu County (1,027 €/m2). In comparison to the average of the previous 12 months prices only dropped in Lääne County and Põlva County but the price drop was caused by changes in the structure of transactions rather than the impact of coronavirus.

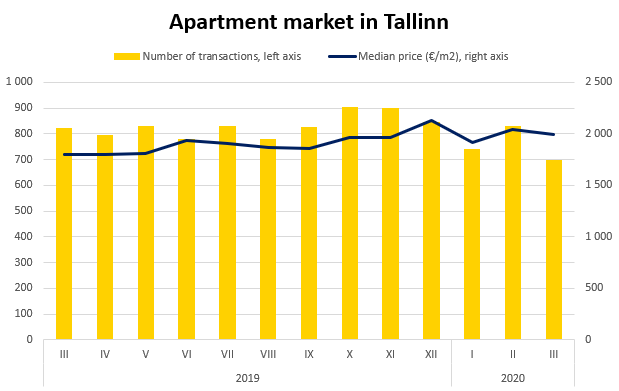

Apartment market in Tallinn

In Tallinn, 697 sales-purchase transactions were concluded in March, which was nearly 130 less than the average of the previous 12 months and also less than in January and February. Tallinn and Harju County, as the market most open to the impacts of the external environment and most liquid, has thus already reacted to the changes, even though we shall have a better overview of the changes already in the next months.

The median price that greatly reflected the activities having taken place in the previous months was 1,994 €/m2, exceeding the median price of the previous 12 months by 4.3%.

Neither the secondary market nor the market of new developments have yet shown any decline in the asking prices. The first nervous movements shall probably be made by the people who have already concluded contracts under the Law of Obligations for new developments and for whom the obligation to sell the current home is becoming increasingly imminent.

As for developers, the difficulties may be greater for those whose share of loan obligations is higher, as the companies building with their own investments are more flexible. According to real estate agents, activity is more healthy in rural areas, even though today it is too early to say whether the current crisis will activate a wave of movement from town to country. However, we shall see the first price corrections in a few months

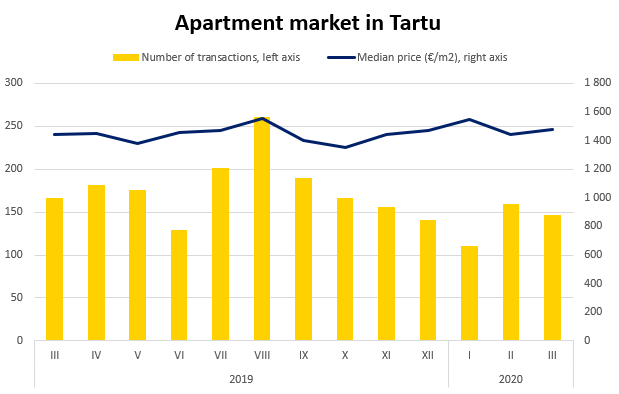

Apartment market in Tartu

March was active also in Tartu where 147 transactions were concluded. In comparison to the average of the previous 12 months, the number of transactions dropped by more than 30. The result was also lower than the figure of last March by 20 transactions.

The median price of transactions in Tartu was 1,476 €/m2 and that was nearly 20 €/m2 higher than the average of the previous 12 months, thus remaining at the level of the previous periods. As in Tallinn, the number of lease offers has also increased in Tartu but both sales and lease activity in the market is low.

Similarly to Tallinn, the crisis has hit harder the people who have bought new apartments from the rising market but have to sell their old apartments already in the bear market. The next months will probably also bring along sales of other homes and summer houses in order to maintain a financial buffer in difficult times.

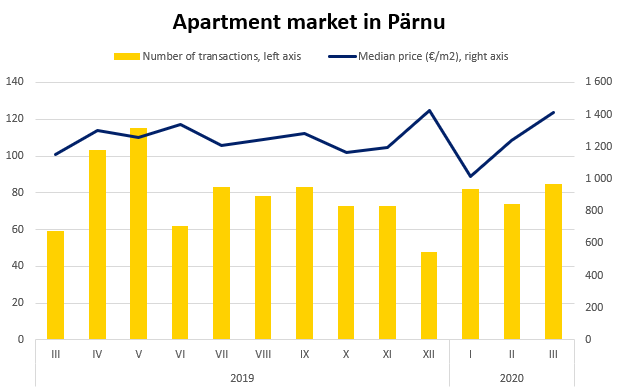

Apartment market in Pärnu

According to the real estate agents, sad tidings have also reached Pärnu, even though the figures of March were still nice in the summer capital. 85 transactions were concluded in March, which was 7 more than the average of the previous 12 months and also more than in January or February.

The median price of transactions, however, was the highest of all time, 1,412 €/m2, exceeding the average figure of the previous 12 months by 13%. The next months will bring a difficult period to Pärnu, as the economy which is strongly focused on service and short-term lease will be subject to a severe trial.

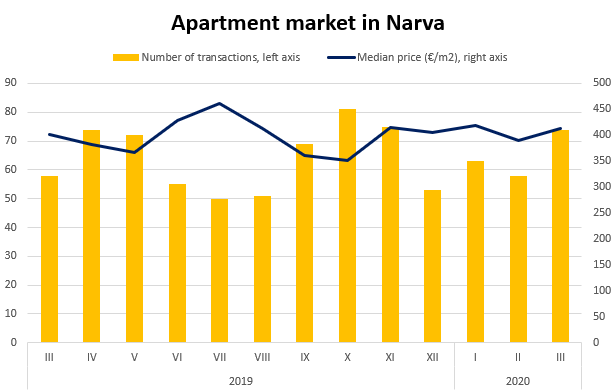

Apartment market in Narva

The market of Narva was active in March, 74 sales-purchase transactions were concluded, which was 11 transactions more than the average of the previous 12 months. The median price of transactions was also higher in Narva than the average of the previous 12 months – 413 €/m2 i.e. 16 €/m2 higher, which in absolute figures, of course, is an insignificant amount.

In addition to previous agreements, one possible explanation to the high activity in the market in Narva in March is also the media consumption of the local people due to which the possible impacts of the virus were acknowledged slightly later than in most of the Estonian territory.

The prices in Ida-Viru County, which next to Valga County are the lowest in Estonia, shall probably experience the smallest setback in absolute numbers, but also according to the real estate agents there a 20% price drop may be expected if the crisis is prolonged.

Igor Habal, Uus Maa Real Estate Agency analytic